"I Own Uranium, Do You?" - Arthur Breitman's Keynote at Consensus 2025.

Real Asset Tokenization on Tezos - No Theater, Just Ownership.

5 minute read

Arthur Breitman recently took the stage at Consensus 2025 in a t-shirt that read “I own uranium,” it wasn’t just a clever slogan. It was a statement of intent, and a preview of one of the most practical and refreshingly grounded keynotes in the conference.

Instead of lofty talk about the future, Arthur walked the audience through something real: a live, on-chain purchase of a highly regulated commodity, powered by Tezos. And he made his point early:

“We really have uranium. The actual metal. Or to be specific, the metal oxide… sometimes called yellow cake. You can actually buy physical uranium, on Tezos.”

Why Uranium? Why Now? #

Uranium might seem like an unlikely poster child for blockchain, but Arthur made a compelling case. Demand for nuclear energy is rising, driven by carbon reduction goals and the energy needs of AI infrastructure. Yet access to uranium markets is limited, trades typically happen over-the-counter, require very high minimums, and are out of reach for nearly everyone.

“Everyone knows uranium, and there’s just no accessible market for it. So let’s create one.”

This is where tokenization becomes useful, not as marketing theater, but as a bridge to real ownership and open markets. The result: xU308, a token representing physical uranium oxide, available 24/7 on-chain, with transparent custody and no asset management fees.

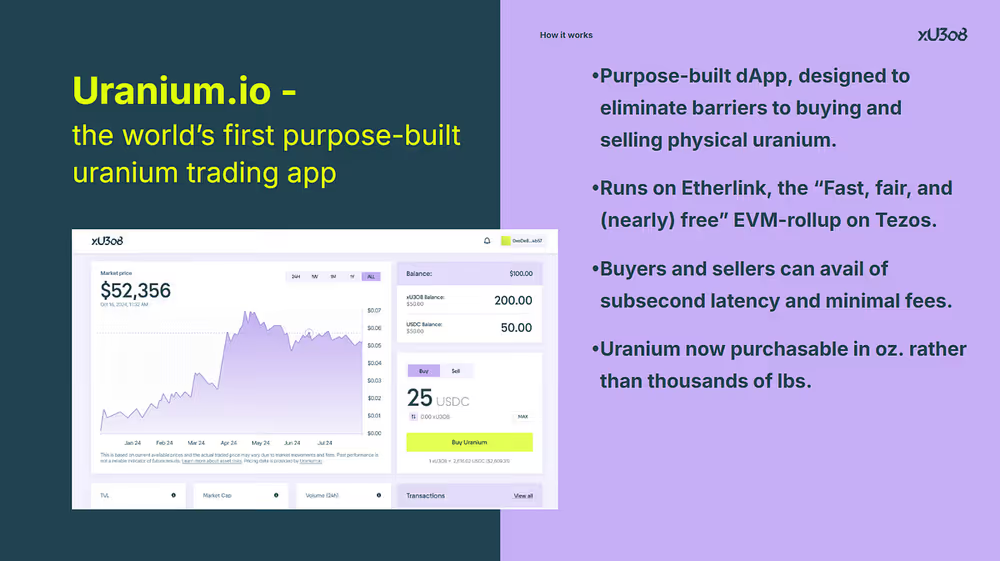

The Live Demo: Buying Uranium in 3 Steps #

The highlight of the keynote was a three-step demo showing how simple it is to buy uranium today:

- Step 1: Sign in at uranium.io with just an email

- Step 2: Deposit USDC directly on Tezos’ Etherlink rollup via Transak

- Step 3: Purchase as little as $10 worth of uranium (or even less)

“So here’s how you can be the proud owner of $10 worth of uranium, in just three simple steps.”

That’s not just symbolic, it’s real legal ownership, verified on-chain and backed by regulated infrastructure involving Archax (FCA-regulated), Cameco (uranium custodian), and a trustee framework.

And yes, if you happen to operate a licensed nuclear facility, you can even request physical delivery.

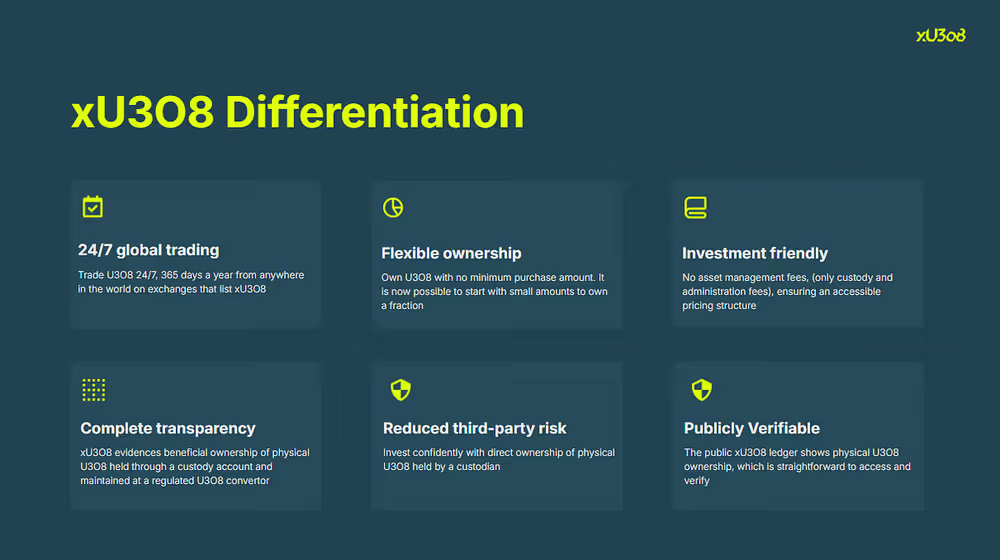

Real Differentiation: Not Another Fund or ETF #

Arthur contrasted xU308 with the usual ways people gain exposure to uranium, ETFs, managed funds, or company stocks. What sets this apart, he explained, is that xU308 offers direct legal ownership of physical uranium. This isn’t a share in a fund or a speculative play on a company’s stock. You own the asset itself, with verifiable custody and no layers of abstraction in between.

Unlike traditional investment vehicles, xU308 eliminates intermediaries. It’s fully digital, globally accessible, and doesn’t require a broker or specialized trading account. Ownership is transparent and on-chain, and thanks to Tezos’ Etherlink, trades settle almost instantly with sub-second confirmation.

While ETFs might offer market exposure, they often trade at a discount and don’t closely track the price of the underlying commodity due to a lack of redemption mechanisms. Futures and mining stocks, meanwhile, are volatile and speculative, and they don’t represent actual ownership of uranium.

xU308 changes that. This is uranium, tokenized and accessible, with legal clarity and real-world backing. It’s not a proxy, it’s the real thing.

Tezos’ “Etherlink”: The Infrastructure That Makes It Possible #

None of this would be possible without Tezos and its EVM-compatible Layer 2 “Etherlink”. In his keynote, Arthur didn’t just present it as another L2, he emphasized why Etherlink stands apart from what dominates the Ethereum ecosystem today.

He pointed out that most Ethereum rollups, despite their claims of decentralization, ultimately rely on centralized control.

“At the end of the day, you look at the fine print, they have a security committee, which has a multi-signature that can do anything it wants to the rollup.”

Etherlink takes a different path. It’s built to be non-custodial from the ground up, avoiding the central points of failure that have plagued other networks. Transactions are confirmed in under a second, with finality reached in around 16 seconds, fast enough to power real-time markets. Unlike most L2s, Etherlink allows for sequencer rotation, ensuring fairness in transaction ordering and long-term neutrality.

As Arthur described it, Etherlink isn’t just another Layer 2 competing for attention.

“Etherlink is not custodial. You can think of it not as a VC funded competing project [that] it just happens to be launched on Tezos. It’s an extension of the network.”

That foundation makes projects like xU308 possible, delivering real-world assets on-chain without compromising on decentralization, performance, or trust.

More Than a Demo #

What Arthur delivered at Consensus wasn’t just a cool use case. It was a fully working, permissionless product that anyone can use today. In an industry full of half-baked tokenization schemes, this one stands out.

Arthur mentioned in the keynote with a smile and a simple provocation:

“I own uranium. Do you?”

It’s a line that sums up both the accessibility of what Tezos has built and the seriousness of its ambition. Real-world assets don’t have to be locked behind legal walls, fund managers, and middlemen. Blockchain can change that. And with xU308, it already has.

If you’re still wondering whether this is real, there’s only one way to find out.