Overview: Active DAOs on Tezos

In this article, we're reviewing the status of several DAOs currently active on the Tezos blockchain.

2,100 words, 11 minute read

Editorial note: The following article contains discussion of Decentralized Finance (DeFi). DeFi refers to a relatively new financial system based on blockchain, that decentralizes the infrastructure, processes, and technologies used in traditional financial transactions. As such, when it comes to DeFi, the regulatory framework that exists around traditional finance is incomplete and evolving. It is important that readers do their own research, and understand that coverage of DeFi products and services on Spotlight does not constitute endorsement by either the Spotlight editorial board, Blokhaus Inc, or any affiliated organizations.**

A Decentralized Autonomous Organization, or ‘DAO’, is a mechanism that allows a decentralized project to be governed by its community, and several have found a home on Tezos.

In this article, we will review the status of several DAOs currently active on the Tezos blockchain. We will cover what a DAO is, how they work, and we will take a survey of some of the existing and upcoming DAOs on Tezos. Finally, we will look at the tool that makes it easy for users to create their own DAOs for their project.

What is a DAO? #

Just as the Internet itself ushered in a new era for the way that human beings communicate and conduct business with each other, cryptocurrencies and blockchain technology have the potential to transform the ways in which communities form around shared interests. One example of how this new wave has taken shape is DAOs.

The term ‘DAO’ stands for ‘Decentralized Autonomous Organization’. DAOs usually consist of dispersed (or decentralized) communities of people that organize around some common shared interest on the Internet.

In the crypto space, a DAO might form around a DeFi application, an NFT platform, a play-to-earn gaming project, or any other kind of project built on the blockchain. They usually involve some kind of discourse around new features that the community would like to see integrated to the product or platform in question, and these discussions eventually lead to proposals that contain the code required to make the changes. Once posted, the community of DAO participants vote on said proposals with some kind of governance token, which may or may not have some kind of monetary value.

DAO Tokens & Proof-of-Stake #

DAO tokens function as a way for participants to prove they have a stake in the platform, one way or another, and thus it is through a participant’s Proof-of-Stake that they earn the right to vote on important issues. Different DAOs have different ways of distributing their governance tokens depending on their purpose, and whether or not a DAO token carries monetary value is usually a function of community behavior in the open market. That is, since DAO tokens live on open and permissionless cryptocurrency networks, it is always possible for them to form the basis of a market if the community so chooses.

Arguably, the Tezos blockchain itself might be regarded as one large DAO, since the core protocol is maintained by the community in a decentralized way via Proof-of-Stake and a unique on-chain governance mechanism. As such, it’s no surprise that Tezos should find itself a home for DAOs.

DAOs on Tezos #

Below is a list of some of the most active DAOs that currently operate on Tezos. Please note that this list is not exhaustive.

Kolibri DAO

Kolibri.finance is a DeFi platform built by Hover Labs that allows users to create collateralized debt positions (CDPs). With a CDP, users put their tez into a vault as collateral, and then borrow a synthetic stable coin, KUSD, against the value of their collateral. Price oracles track the market value of the borrowed amount against the value of the collateral to create liquidation prices on the collateral.

Kolibri is a Tezos based stablecoin built on Collateralized Debt Positions (CDPs) known as Ovens.

Kolibri uses CDPs (referred to as an Oven) to collateralize a soft pegged USD-stable value asset, kUSD. - Kolibri.finance

Kolibri was the first algorithmic stable coin on Tezos and it was the first platform to form a fully functioning, active DAO. Since its inception, the Kolibri DAO has run through thirty three proposals. It utilizes the kDAO token.

Youves DAO

is another DeFi platform similar to Kolibri which offers synthetic asset borrowing and CDPs. Users can make use of the Youves platform to create leveraged positions on their tez, or borrow the Youves dollar, uUSD, to participate in other kinds of DeFi activities. When users create a Youves CDP, a price oracle is used to track the market value of the borrowed uUSD amount against the value of tez that is collateralized, creating a liquidation price point which helps to algorithmically keep the uUSD asset closely pegged to a dollar.

Youves is a decentralised, non-custodial and self-governed platform for the creation and management of synthetic assets. Minters of synthetic assets earn a passive income in YOU, the governance token on youves.

YOU tokens are awarded to youves minters, liquidity providers and ubinetic that kick-started the youves platform. Youves is a decentralised autonomous organisation (DAO) governed by many YOU holders who have voting rights to govern the development of the youves platform. - Youves.com

The platform uses the YOU token for governance, which users who borrow uUSD earn while their positions are open. Thus far, the Youves platform has had nine successful protocol improvement proposals voted on.

SalsaDAO

The ecosystem was formed on Tezos in early 2021. The ecosystem consists of the complete line of DeFi, NFT, and gaming products built by Genius Contracts. These products include: Spicyswap DEX, Matter DeFi, SalsaDAO on-chain dynamic NFTs, an NFT DEX (called ArtDEX), and the SalsaDAO gaming hall. Many of these products have showcased a number of ‘firsts’ on Tezos, such as decentralized limit order and flash loans on Spicyswap DEX.

SalsaDAO is the community organization that governs all of the products released by Genius Contracts, including the Spicyswap DEX, Matter DeFi, the SalsaDAO Gaming Hall, and more as the ecosystem continues to grow. - SalsaDAO Guidebook

The SalsaDAO governance portal code was modeled on the Kolibri DAO. It utilizes the sDAO token, which can also be curve locked to whitelist tokens on the Spicyswap DEX. All sDAO tokens have been distributed throughout 2021 and 2022, and thus far, the SalsaDAO has conducted eight votes on SalsaDAO improvement proposals, most of which were to adjust the yield rates on Matter DeFi core farms.

Plenty DAO/Plenty.Network

is a DeFi platform built by Tezsure. The platform offers one of the highest liquidity DEXs on Tezos, including many stable coin flat curve pools, and it presented the Tezos ecosystem with some of the earliest yield farms. The team behind Plenty also built cTEZ, the synthetic tez asset that uses checker, and they recently took over and rebuilt the Ethereum to Tezos bridge, initially created by Wrap Protocol.

Plenty is expanding DeFi use cases on Tezos towards a full scale decentralized financial ecosystem. Empowering traders, liquidity providers & developers to participate in an open financial marketplace. -plentydefi.com

To date, the Plenty DAO has voted on three proposals. The platform currently utilizes the xPlenty token, however the platform is being rebranded as plenty.network soon and will utilize the new PLY token (a new token that is a mix of the older PLENTY token and the WRAP protocol token, which the Plenty team acquired). The team is currently testing some of the new platform mechanics on the ghostnet.

Works-in-progress: #

The following are some notable projects that either have a DAO in the works or have plans to implement a DAO in the future.

Crunchy DAO

Crunchy.network is a DeFi and NFT tooling platform built by Codecrafting Labs. Crunchy was the first platform on Tezos to offer Farms-as-a-Service, and other DeFi tools like Deep Freezers. The team has also created WTZ, a wrapped tez asset that offers a 1:1 mint ratio, and they recently released the first DEX aggregator on Tezos, helping traders get the most efficient price for their swaps.

Crunchy provides DeFi services and solutions on Tezos to projects, developers, and end users. Crunchy is maintained by independent developers and is governed by CrDAO holders. -crunchy.network

At the time that this article was written, the Crunchy DAO has not voted on any proposals yet due to a technical hold up, but the community is very active and devs are working on the finishing touches to get the first proposals up soon.

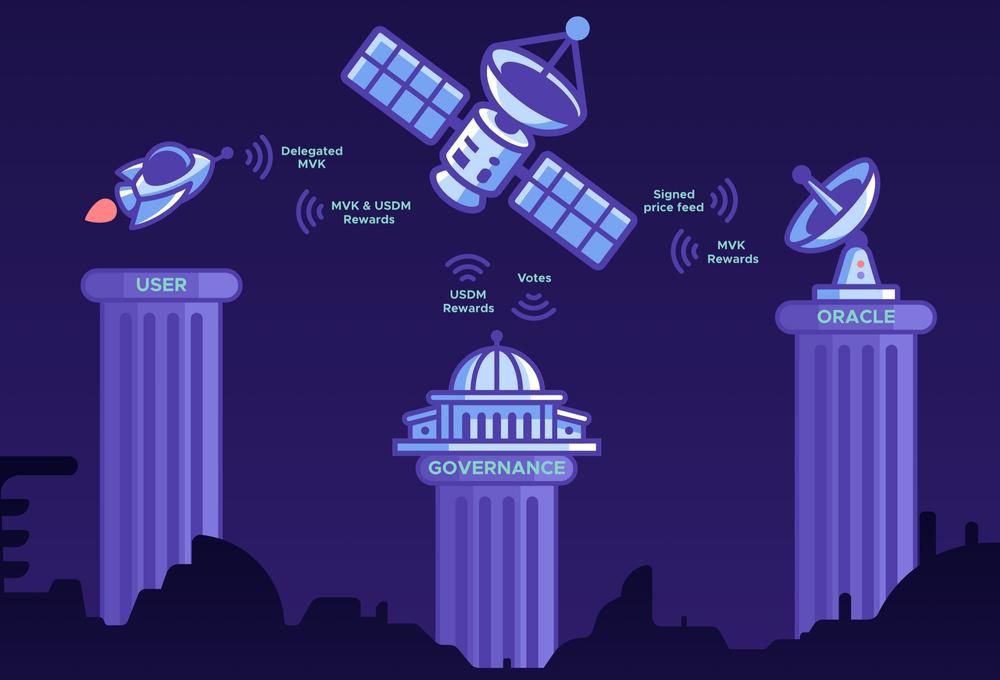

Mavryk Finance

Mavryk Finance is a decentralized, non-custodial, (soon-to-be) community-governed financial platform that is currently being built on Tezos. Though the future possibilities of what Mavryk can offer the Tezos ecosystem are expansive, the first feature that Mavryk will offer is multi-asset backed loans.

Similar to the way other decentralized lending platforms like Kolibri and Youves work, Mavryk finance will allow users to borrow a synthetic asset, USDM, against collateralized assets. One main difference being that where the former platforms currently only support collateralizing tez, Mavryk plans to utilize their decentralized oracles to allow users to borrow against multiple assets, or multi-asset baskets.

Additionally, Mavryk is a community-governed entity and rewards stakeholder participation in governance & signing oracle price feeds, in order to bring stability and prosperity to the platform. - Mavryk.finance

The platform will use the MVK/sMVK token for governance. (MVK is a transferable version of the governance token, but sMVK will be a non-transferable representation of staked MVK, and this sMVK will be used for direct voting rights.)

For more information, see the Mavryk litepaper.

Tezos Domains

is a platform on Tezos that allows users to register unique names to a specified public address. Each domain that is registered is one of a kind and is followed by .tez. For example, one can turn a public address that is usually a long string of characters like tz1VB…Zx2E into the much simpler ‘alice.tez’. These names are transferable tokens and when registered to an address they function as a public address to which assets can be sent.

Though there is currently no DAO component live for Tezos Domains, it was was recently announced that the team plans to have a DAO up and running by Q4 of 2022.

Tezotopia/Gif.Games

is a play to earn style NFT game on the Tezos blockchain that melds together the world of gaming, NFTs, and DeFi. It is one of the first full system gaming experiences on Tezos, offering a land map, allowing users to farm precious minerals/materials, conduct in-game battles, and more.

The game has an identified native governance token, GIF, though currently its main utility is staking to allow GIF holders to take a share of the in-game marketplace revenues.

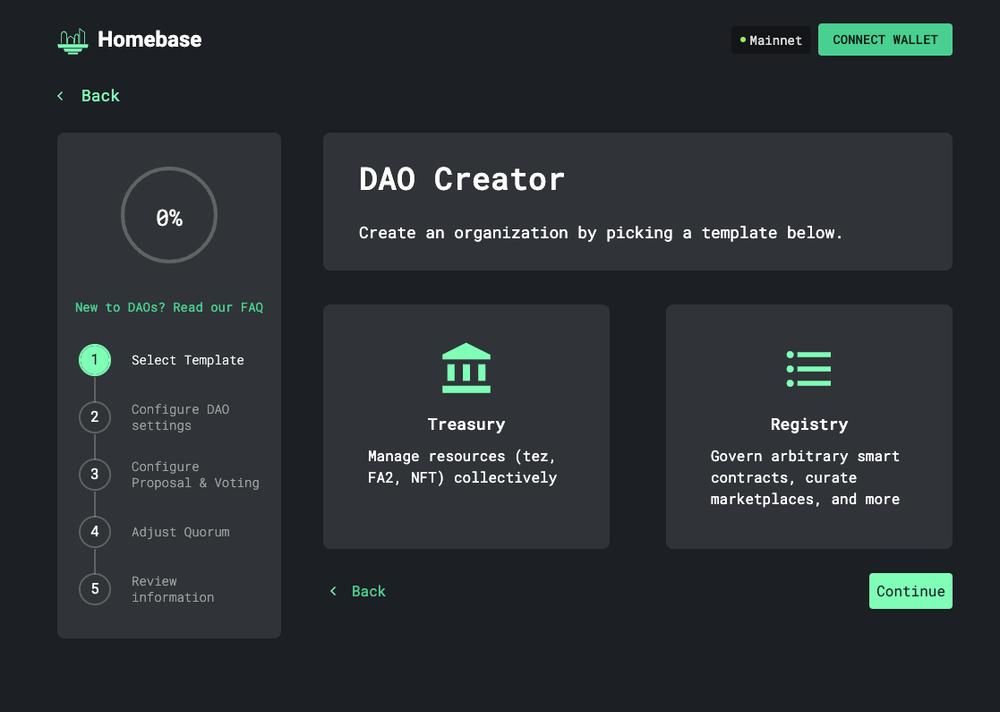

Tezos Homebase - a tool for building your DAO

If you have a new project and want to create your own DAO, the good news is you don’t have to build the governance infrastructure from scratch. is a ready made tool that makes it easier for Tezos community members to create their own DAOs.

Homebase is a web application that enables users to create and manage/use DAOs on the Tezos blockchain. This application aims to help empower community members and developers to launch and participate in Tezos-based DAOs. - Tezos-homebase.io

The application offers a template where you can select from managing a treasury of resources or a registry allowing you to govern arbitrary smart contracts, curate market places, and more. Users can customize various DAO configurations and parameters, such as Quorum, with the template.

To learn more about any of the aforementioned DAOs on Tezos or Tezos Homebase, be sure to visit the corresponding websites and refer to the appropriate documentation.