Dex Aggregators on Tezos

A closer look at the growth of the Tezos DeFi scene, as more projects and products are being launched.

Originally published at Tezos Commons News

950 words, 5 minute read

The Tezos DeFi scene is constantly growing with more and more projects and products being launched constantly. One such space with large growth is in the Tezos decentralized finance space, which allows users to swap between various tokens on the Tezos blockchain.

From a single Dex (’ decentralized exchange’) with just a few pools that we had back in late 2020 when Tezos Defi was just starting, we now have 6+ decentralized exchanges, each with dozens of different token pools and on top of that there are also independent token pools like the “Liquidity Baking AMM” and “CTez” with its built-in AMM(‘automated market maker’).

All these different decentralized exchanges and token pools make it pretty time consuming for someone trying to find the best exchange rates for the tokens that they want to swap. By the time you check the price on five or six different decentralized exchanges, the prices have changed already and you have to go again from the start. Definitely not an efficient way, right? Well, there is a solution for this and it’s called the “Dex Aggregators”.

What are Dex aggregators and how do they work? #

Dex aggregators are platforms that allow users to swap between tokens by aggregating the data from all the different decentralized exchanges and pools they support, and give you the best exchange rate for your tokens.

These platforms use complicated algorithms to scan the various token pools, their liquidity, and other relevant data so that they can calculate the best and most profitable ways to swap your tokens, giving you the most return on value. They take into account all the different parameters like the trading fees each dex uses, the network fees, and it all happens through a simple interface that anyone can use.

They don’t just find the best exchange rate on one of the dex’s and swap your tokens on it (thats what Dex routers do), but they also break down your tokens into smaller amounts to trade them on multiple dexes in the same block so you can get the least amount of slippage for the amount you are trying to swap and once again getting you the best bang for your buck.

But wait! There’s more!

The more advanced aggregators (like the ones we will see below) go even further and actually swap your tokens through many different token pools (even tokens that are not related to the tokens you are swapping) to give you the most profitable route you could possibly find. In a way, they are basically taking advantage of the various arbitrage opportunities that exist between all the token pools they support, and it all happens automatically for you with just a few clicks. Let’s take a look at an example trade where I want to swap some XTZ to USDT using an aggregator.

Example #

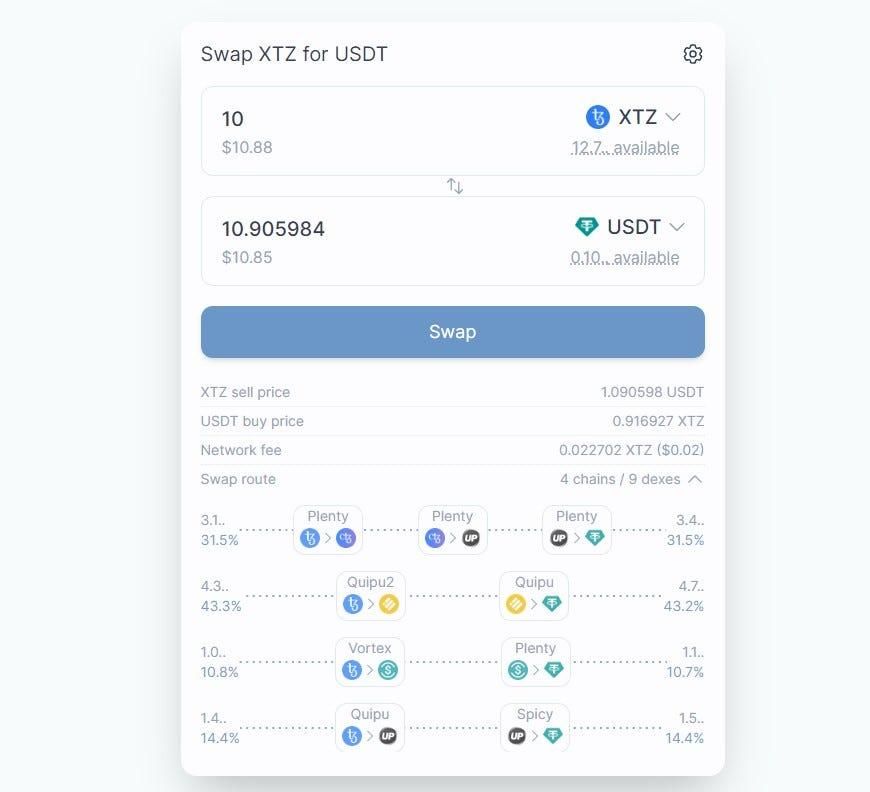

In the example above I am trying to swap 10 XTZ to USDT and what we see happening is the following:

- 31.5% of my XTZ will be swapped to CTEZ, then the CTEZ to UP and then finally to USDT, all these swaps will happen on the Plenty Dex.

- 43.3% of my XTZ will be swapped to ABBUSD on QuipuSwap V2 , and then ABBUSD to USDT on QuipuSwap.

- 10.8% of my XTZ will be swapped to USDtz on the Vortex Dex and then the USDtz to USDT on the Plenty Dex and lastly

- 14.4% of my XTZ will be swapped to UP on QuipuSwap Dex and then the UP to USDT on the Spicy Dex.

So as we can see, the aggregator automatically calculates and breaks the amount I want to swap into 4 smaller ones and utilizes 9 different token pools from 4 different decentralized exchanges and all that action occurs in one block.

As we said before, while doing all of these actions, it also takes into account the trading fees, the network fees, and other parameters. As a result we get back more tokens (in this case USDT) than what we would get from swapping the whole amount on a single decentralized exchange (this becomes even more evident when you try to swap bigger amounts).

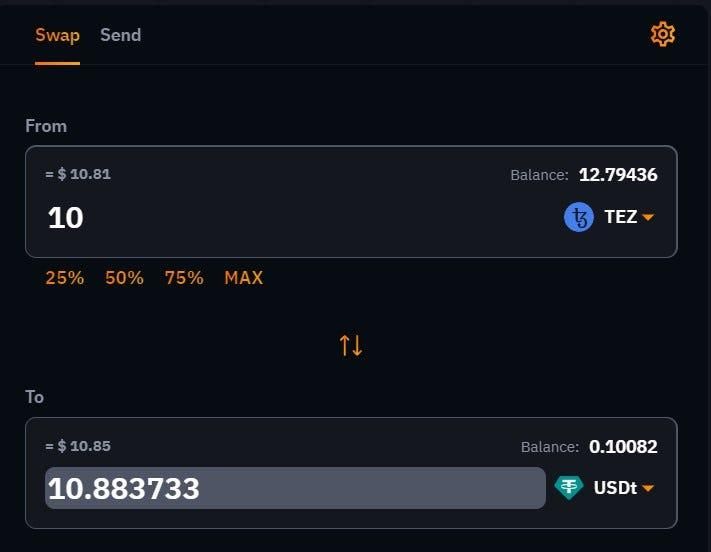

Single Dex swap screenshot that was taken at the same time with the screenshot of the aggregator swap above for comparison.

Dex Aggregators on Tezos #

The dex aggregators are a super useful tool that you can use in DeFi to maximize your swap profits and efficiency so let’s take a look at some of the best dex aggregators you can use on Tezos.

Being part of the much bigger Crunchy.network ecosystem, the Crunchy aggregator offers all the features I mentioned above (ex. split pool weight trading) while at the same time it offers you the convenience of using other great defi tools like the defi portofolio tracker, farms, and the recently launched Tezos token tracker from within their DApp’s website.

Supporting more than 400 liquidity pools from 8 different dexes, the 3route aggregator will often give you the best exchange rates for your swaps. Also built by a great team (Baking Bad) and with a very user-friendly interface, it’s no wonder 3route is one of the most used DApps on Tezos.

In conclusion, Tezos’ dex aggregators are a valuable tool for anyone looking to trade their Tezos tokens in a decentralized, convenient, and efficient manner. With their user-friendly interfaces, they make it easy even for Defi newbies to get the best exchange rates possible out of their trades!

If this article helped you understand how dex aggregators work, make sure to share it and of course subscribe for more!