How to Stake on Tezos

This post covers the staking user experience introduced with the Paris protocol upgrade. We present different staking scenarios and explain their consequences.

9 minute read

NOTE: Following the Quebec, Rio, and Seoul protocol upgrades, staking rewards are now 3x delegation rewards, while cycles have been shortened to 1 day. Unstaking also finalizes automatically. For more information, please visit stake.tezos.com.

As of the Paris protocol upgrade, there are two ways to be involved in Proof-of-Stake on Tezos, apart from baking.

Briefly put, baking means running a machine that is part of securing the Tezos network. Bakers produce blocks, maintain consensus, and vote on governance questions. To obtain the rights to do so, bakers must stake funds, which are frozen by the protocol and subject to economic penalties, slashing, if the baker misbehaves. For the work and risk involved, bakers receive rewards in proportion to their stake.

For a more detailed tutorial for bakers, see this guide by Tezos Commons.

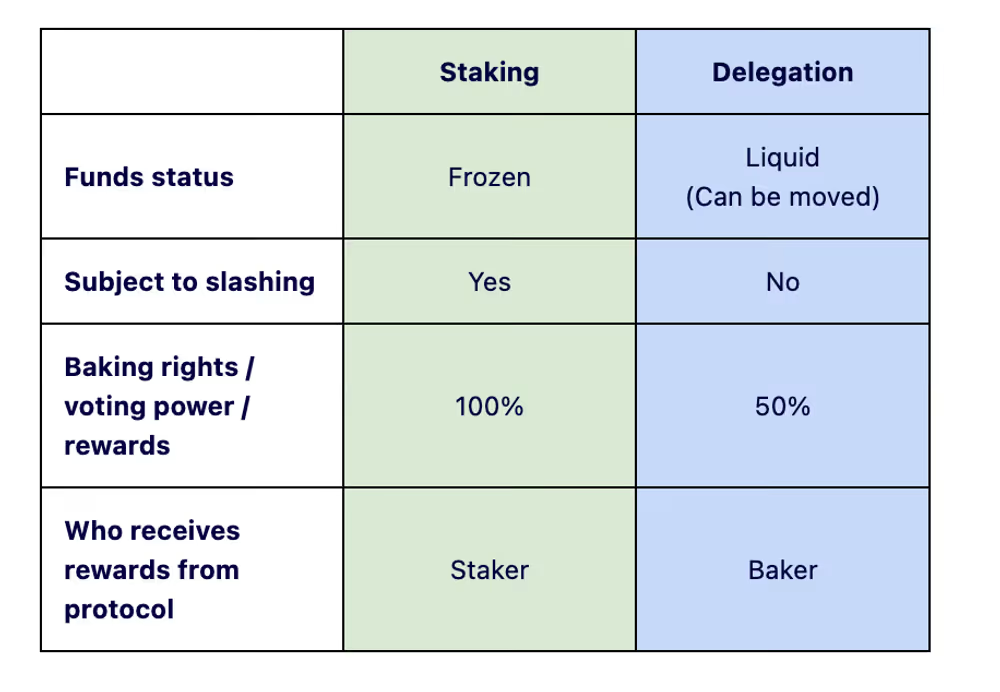

Others can also participate in staking and receive rewards directly from the protocol, which is the focus of this blog post. It’s done by choosing a baker and letting your funds count towards that baker’s stake. The funds remain in your account but are frozen by the protocol and subject to slashing, just like the baker’s funds.

An alternative to staking is delegation, which lets you contribute to a baker’s stake without the funds being frozen or subject to slashing. However, delegated funds carry only half the weight for receiving baking rights (and hence rewards), and when voting in governance. Also, rewards coming from delegated funds are paid out to the baker, not to the delegator. It is then up to the baker to decide whether they are redistributed.

In short, staked funds are incentivized more because they contribute more to network security by being actually at stake.

Becoming a staker #

First you need to choose a baker that you will be staking with. There’s a couple of things to keep in mind.

Staked funds are at stake. If your baker engages in double-signing – whether intentional or accidental – your funds are subject to the same economic penalties as the baker’s own funds, slashing. Slashing is a very rare event and the risk is very low, but it is not zero. It has occurred on a few occasions since Tezos launched.

Overstaking. Bakers decide if they are open to external stake and how much stake they accept. Adding stake beyond a baker’s limit will result in reduced rewards for stakers, so make sure to check that the baker is open to more stake. Note that a baker can also become overstaked after you join (see the section on overstaking below).

Baker fee. Bakers can define a fee that is taken out of the rewards for external stakers. The amount varies from baker to baker, so always make sure your baker’s policy is acceptable to you. Fee changes are applied 5 cycles (~14 days) after the baker makes the change, giving stakers time to act accordingly.

Delegation. Rewards coming from delegation are paid out to the baker. Any further administration happens manually and is unrelated to the Tezos protocol. A baker might redistribute rewards minus a fee, or might not redistribute rewards from delegation at all.

Adding/removing stake #

Once you’ve decided on a baker, the steps are the following:

Delegating your account. Before staking, you must delegate the account you stake from to the baker you want to stake with. It’s done with the ‘set delegate’ command in Octez, or via your wallet’s user interface (provided it offers this functionality). Immediately after, you can add stake.

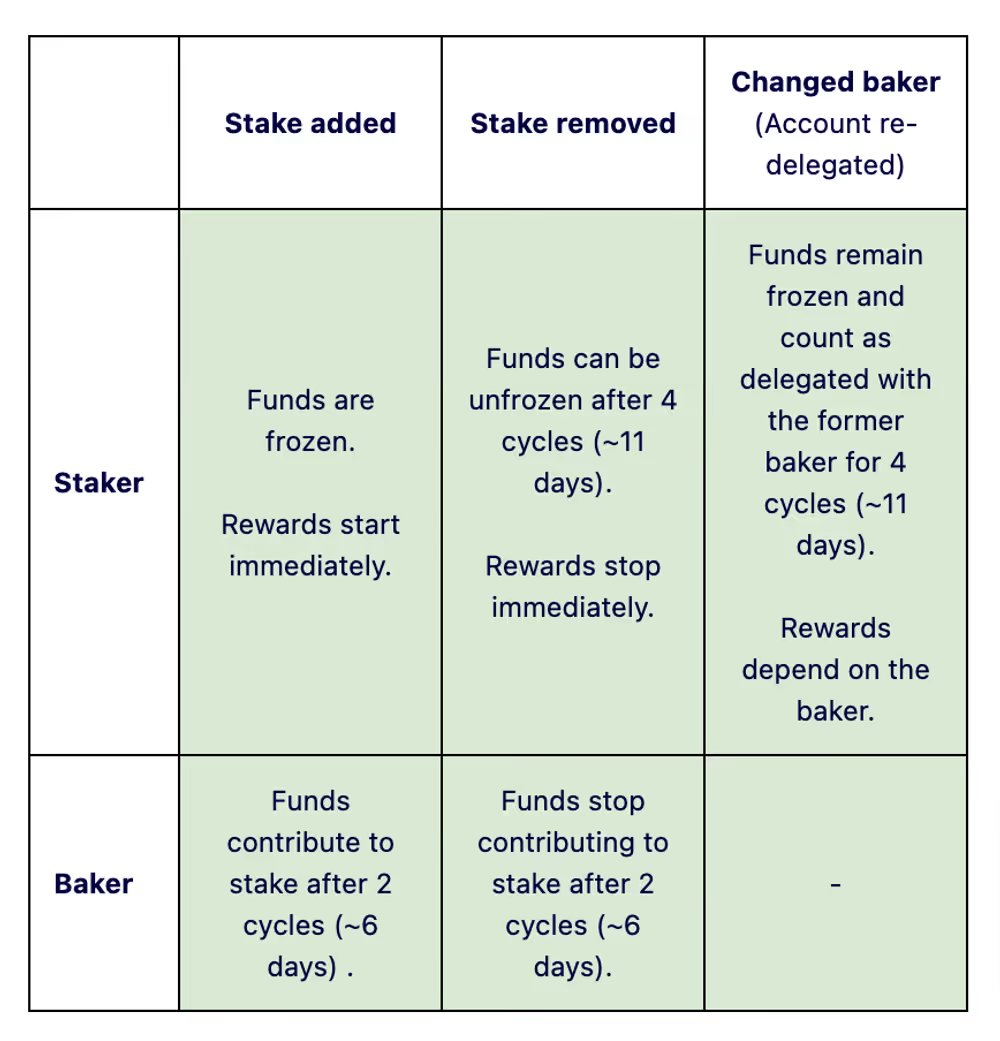

Adding stake is done for a concrete amount with the ‘stake’ command in Octez, or via your wallet’s user interface. The funds stay in your account, but are frozen by the protocol. You will begin receiving rewards immediately after adding stake.

Removing stake is done with the ‘unstake’ command in Octez, or via your wallet’s user interface. The unstaked funds immediately stop generating rewards. They remain frozen for 4 cycles (~11 days), after which you can unfreeze them with the ‘finalize unstake’ command.

Changing baker (re-delegating your account) automatically unstakes everything. After 4 cycles, when the unstaked funds are finalizable, you can stake for your new baker. During this time the unstaked funds count as delegated to your previous baker.

Rewards #

Staking rewards are paid out to the account you stake from and automatically become part of your stake.

Besides the baker’s fee, the amount of rewards you receive depends on the rewards rate, which can fluctuate between 0.25% and 10% annualized1.

This is due to the Adaptive Issuance mechanism that lets the network automatically find the “Goldilocks” level for staking rewards – just enough for a desired level of economic security, but not higher than that, so as to minimize dilution.

The rate adjusts based on the share of tez (out of the total supply) that is staked, with a target of about 50%. If the staked share goes below 48%, rewards increase to incentivize more funds being staked. If it goes above 52%, rewards are reduced to avoid issuing more tez than is required for network security.

Those looking to explore the mechanism further can check out our Adaptive Issuance Simulator, which lets you test various scenarios to see the rewards rate as well as estimated rewards for a given baker.

Overstaking #

Stakers and bakers alike should pay attention to the risk of overstaking.

Bakers are required to stake funds themselves, and can choose to allow up to 5x that amount to be added by external stakers. This defines the baker’s limit.

The protocol doesn’t prevent someone from adding stake beyond the limit, but all stake beyond the limit is regarded as overstaked. Overstaked funds are still frozen, but are otherwise treated as delegated and hence generate only half the baking rights and rewards.

The protocol also doesn’t distinguish between who added stake first and last2. Everyone receives rewards proportional to their share of the baker’s total external stake. Hence, it affects all stakers if someone joins with funds that only generate half the rewards.

Confused? Let’s look at some examples.

Brian starts a baker #

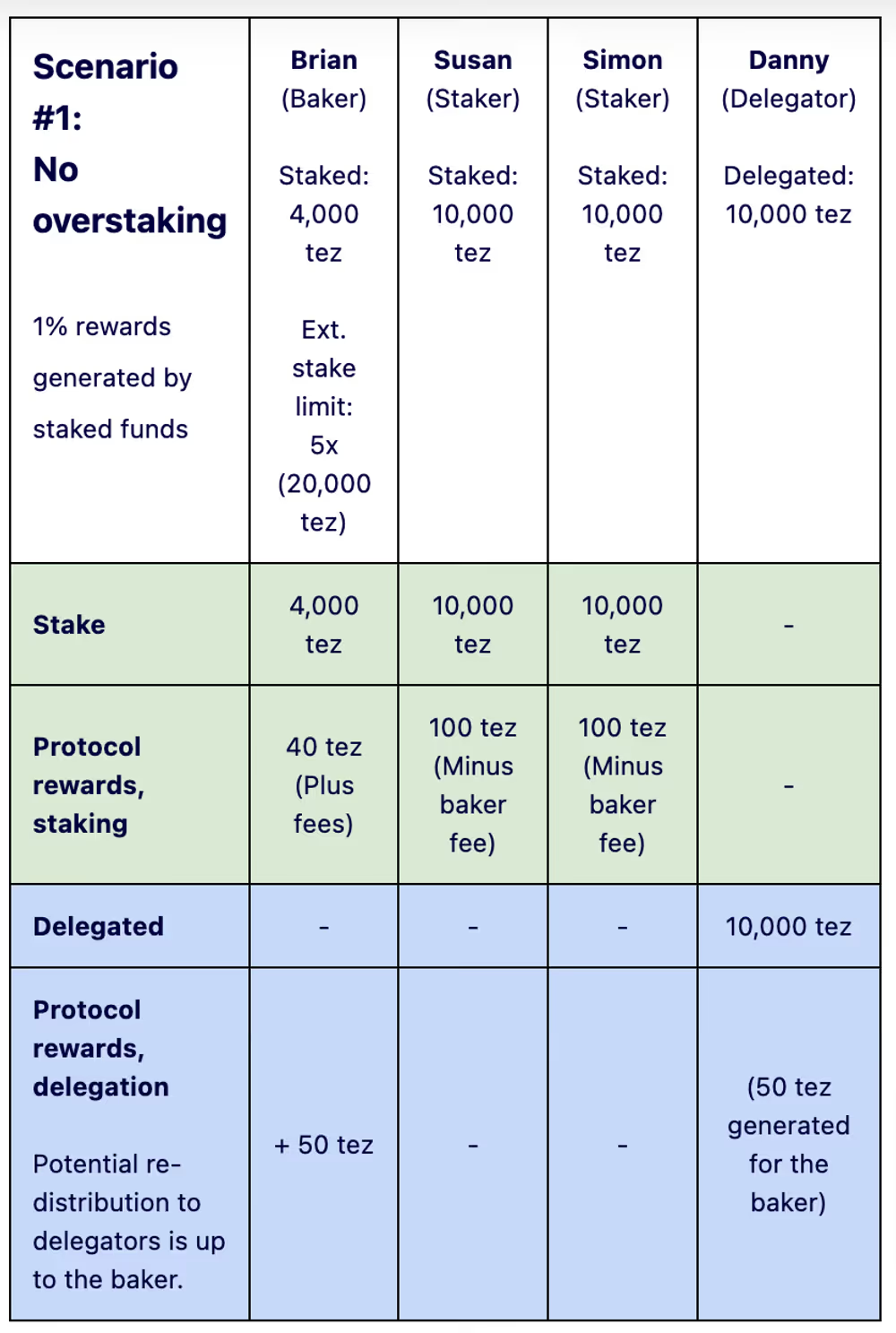

Brian decides to run a baker. He stakes 4,000 tez himself and sets the limit for external stake at the maximum: 5x, making his limit 20,000 tez.

Shortly after, Susan stakes 10,000 tez with Brian’s baker, and Simon does the same. Brian is now at the limit, and everyone is happy. Also, Danny joins as a delegator with 10,000 tez (he needs his funds liquid).

Here’s how it looks after 1% of rewards have accrued to staked funds and 0.5% to delegated funds. For example 6 months with a rewards rate close to 2%.

Brian becomes overstaked #

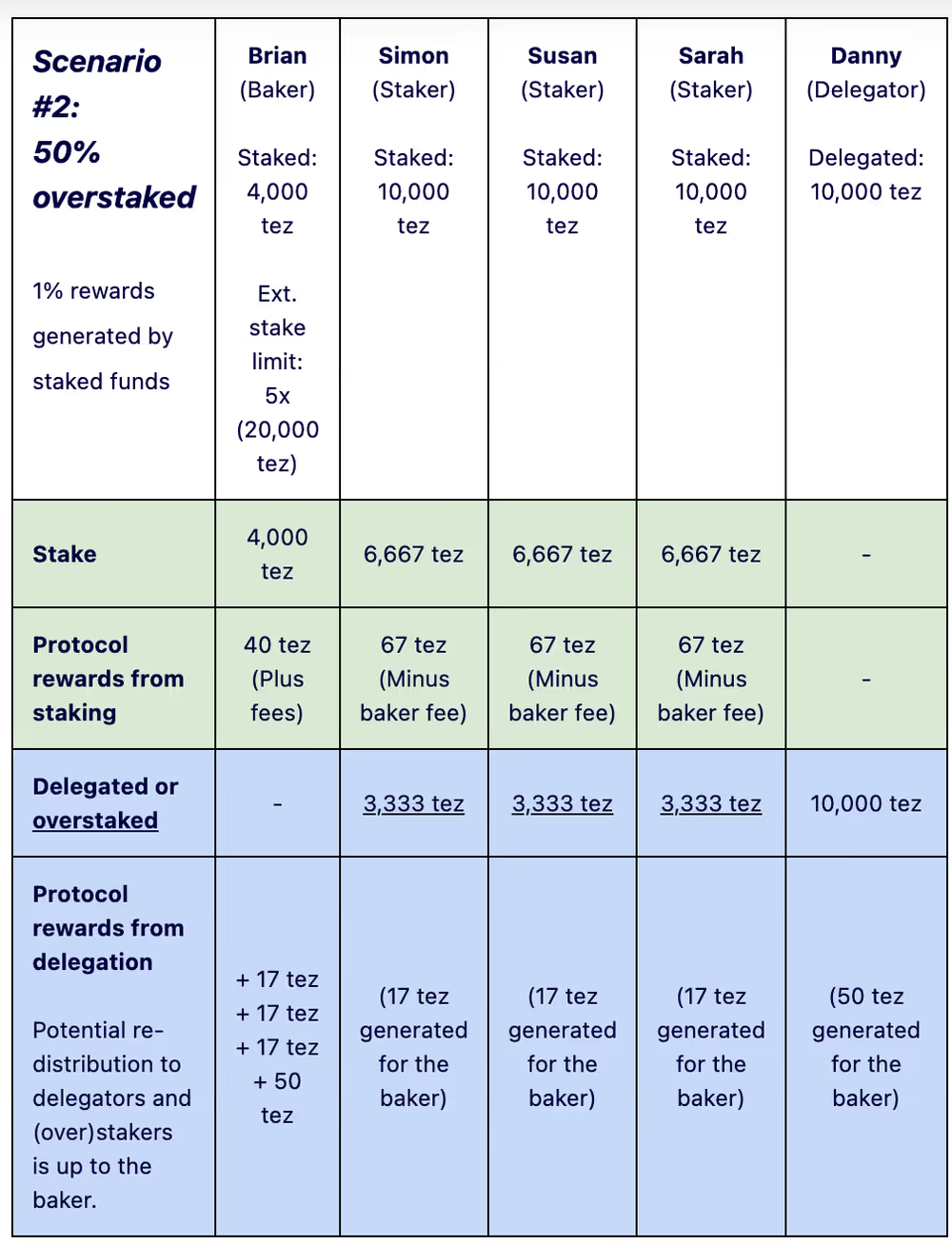

Now imagine the same scenario, but a third staker, Sarah, also joins with 10,000 tez, and baker Brian becomes 50% overstaked.

His multiplier for external stake is already at maximum, 5x, so to account for Sarah and keep everyone happy, he needs to increase his own stake by at least 2,000 tez. Unfortunately, he doesn’t have those funds.

Here’s how it would look with 1% rewards having accrued to staked funds and 0.5% to delegated/overstaked funds.

As shown, overstaking results in reduced rewards and affects all external stakers equally, while the baker’s stake is not affected.

Simon, Susan, and Sarah now receive only 67 tez as staking rewards from the protocol. If Brian were to redistribute all rewards from delegation/overstaking, they would each receive an additional 17 tez for the overstaked funds.

However, the total of 84 tez still leaves a gap to the 100 tez from the non-overstaked scenario.

Pay attention to your baker #

Any redistribution of rewards from delegation/overstaking is a decision and action that depends completely on the baker. It is outside of the scope of the Tezos protocol.

A baker might not have a system in place for monitoring and redistributing rewards from delegation/overstaking. Bakers might even explicitly state that they don’t redistribute payouts for delegation/overstaking.

Keep in mind that overstaking can happen if the baker makes changes after stakers have joined. If Brian originally staked 6,000 tez and then reduced it to 4,000 tez, the outcome in Scenario #2 would be the same.

It should be noted that Scenario #2 assumes a large percentage being overstaked with no action taken by the baker or the stakers, which seems unlikely in practice. For a large baker with a small amount of overstaking, the effects would also be much less noticeable.

Yet, the scenarios illustrate the dynamic at play.

Ready, set, stake #

You should now be well-equipped to begin (or continue) your staking journey, including what to watch out for.

In short: To keep the network healthy and optimize rewards, check your baker’s capacity, limits, and policies – and check in occasionally to see your baker’s status.

If you have questions that remain unanswered, drop us a line on Tezos Agora and we’ll do our best to address them.

Happy staking!

- The 0.25-10% range will only be fully active about 6 months after the Paris protocol’s activation. Until then, the rate will fluctuate in a narrower but gradually widening range. See this post for more information. ↩

- In-protocol tracking of who joins first and last is difficult in practice and may have negative side effects. Additionally, this approach would solve only some overstaking scenarios, while not addressing others. ↩