Lending on Tezos

In previous articles I’ve talked about various Tezos DeFi products like Ctez, the Liquidity baking feature(which also explains how liquidity pools work) and I also made a “Tezos Defi Map” which lists most of the important projects and tools of Tezos Defi separated in categories.

8 minute read

In previous articles I’ve talked about various Tezos DeFi products like Ctez, the Liquidity baking feature(which also explains how liquidity pools work) and I also made a “Tezos Defi Map” which lists most of the important projects and tools of Tezos Defi separated in categories.

One of those categories was “lending platforms” which, in my opinion, is also one of the most important products in a DeFi ecosystem. Since everything DeFi related can seem complicated, in this article I would like to explain in simple terms about how on-chain lending works and which platforms are available for lending on Tezos.

As always, this is not financial advice or a stamp of approval, you should always do your own research. This article is meant to be informative and nothing more. So let’s get into it!

How does on-chain lending work? #

On-chain lending in crypto refers to the process of lending and borrowing digital assets on a blockchain using smart contracts. This allows one to borrow or lend without the need of an intermediate trusted 3rd party. In this system, lenders provide digital assets as liquidity to earn interest, while borrowers put down collateral to take out loans in the form of other digital assets.

In these lending platforms there are usually three main actors: the lenders, the borrowers, and the liquidators.

The lenders are individuals or entities that hold digital assets and are willing to lend them out in exchange for interest. These can include retail investors, hedge funds, or any other market participants. So where is this interest coming from? The answer is from the borrowers!

The borrowers, are individuals or entities that need digital assets and are willing to pay a certain amount of interest to borrow them. These can include traders looking to take on leveraged positions, people that need liquidity to grab another opportunity that is out there, or generally individuals looking to borrow for personal reasons but without losing their exposure to the asset they hold.

The interest rate that they need to pay is usually adjusted automatically and it depends on how much of the total liquidity provided by the lenders is borrowed by the borrowers. The higher the utilization of the liquidity, the higher the interest borrowers have to pay and lenders receive.

Besides the interest that borrowers are charged on their loan, they also need to put down some collateral which is locked in a smart contract (usually named “Vault” or “Pool” or something similar). Contrary to the traditional market where loans can be undercollateralized, in on-chain lending the loan must be overcollateralized at all times.

The required ratio between your loan’s value and your collateral’s value, changes depending on the platform you are using and/or the token you are using as collateral, but usually it is between 140% — 200%. So what happens if your vault’s collateral ratio drops below the percentage required?

This is where the liquidators come in. If your collateral’s value drops a lot or if the interest accrued keeps rising and you don’t provide more collateral or repay your loan, your “vault” might become eligible for liquidation by others.

In that case, the liquidators repay the loan for you, and they get your collateral. Since the “vaults” are overcollateralized, the collateral value should be more than the loan they repay so it’s a net win for them. Keep in mind that while the liquidation of a vault can be done by anyone, there are usually bots running that grab these opportunities. Liquidators have to be quick!

Risks #

Like every DeFi product, on-chain lending also has some risks involved and the better we understand them, the better we can protect ourselves from them. So let’s see some of those risks depending on which role you have in these platforms.

As a lender, when you lend your assets, you provide them as liquidity to be used by the borrowers, this means that you could potentially find yourself in a position where most of the liquidity is used (borrowed) by others and there is not enough liquidity for you to withdraw your funds if you choose to do so. Of course, high liquidity utilization would also mean that the interest rate for borrowers is super high and lenders are getting paid a much higher interest (APY) as well. Eventually more liquidity will be brought from new lenders looking to join in the high APYs.

On the other hand, as a borrower, you need to be aware of the interest rate and your collateral utilization at all times. Since the interest rate is auto adjusting depending on the utilization of total liquidity, you might see sudden raises in the interest rate if for example a lender withdraws a huge chunk of the total liquidity or if suddenly a lot of the liquidity gets borrowed by others. In general as a borrower, you need to always be aware of your collateral utilization so you don’t get liquidated. The name of the game for borrowers is to not get liquidated.

As a liquidator, one risk you could face is that during a huge drop in the markets, the value of the collateral assets you will get from liquidating someone, might drop too fast before you can sell them and not allow you to get a profit on your liquidation. Besides the price drop of the asset you are going to get from a liquidation, you should also be aware of the available liquidity in the exchanges so you don’t get large slippage when your try to sell them.

Note that these are more general risks and since every lending platform has their own design and mechanics on how they work, they might not exist for you. Always check the mechanics and parameters of the platform you are planning to use so you understand them and not get any surprises.

Lending platforms on Tezos #

So now that we have a basic understanding of the on-chain lending concept, let’s see some Tezos projects that allow you to lend your tez and/or use them as collateral to borrow other assets.

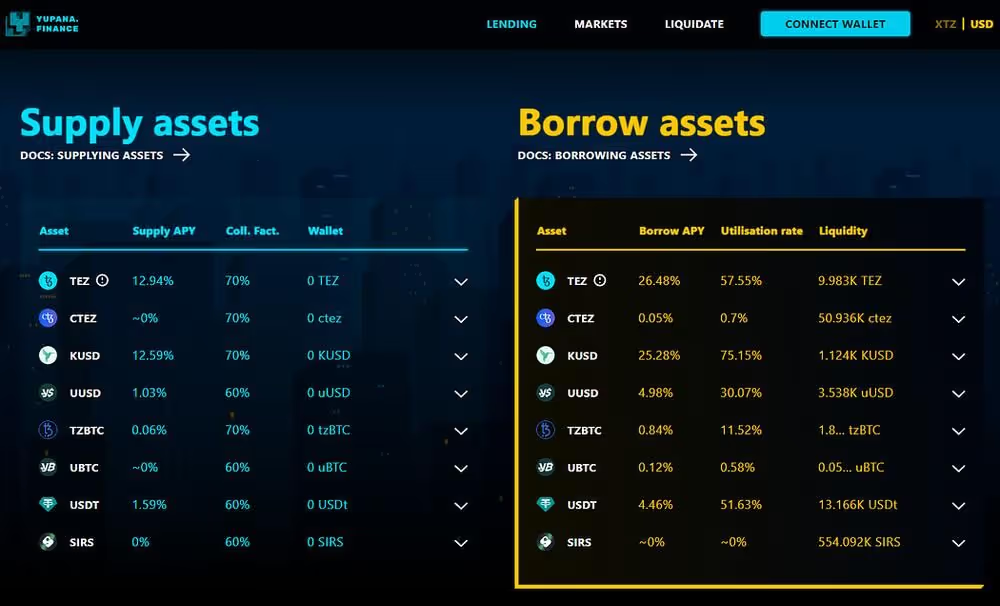

Yupana Finance is a lending platform that allows users to lend and borrow tez and various other Tezos tokens with the interest automatically adjusting based on the the utilization of the liquidity that’s available. Users can also liquidate undercollateralized vaults through the UI.

Tezfin is another on-chain lending platform using an automated interest rate maker, where users can lend and borrow tez and multiple other Tezos tokens like USDtz, ETHtz, BTCtz etc.

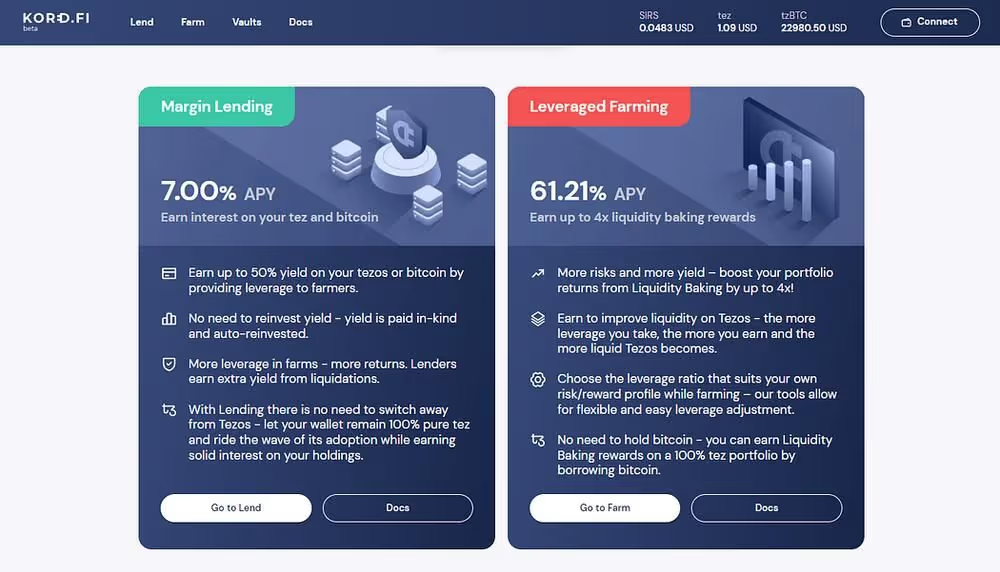

Kord.Fi is a lending platform focused on the Liquidity baking AMM which allows you to lend tez and/or tzBTC. On the other side, you can also borrow up to 4x, which allows you to leverage your positions on tez, tzBTC or SIRS tokens. Liquidations of vaults are also available through the UI.

*note* the tzBTC lending and farming are deactivated at the time of writing due to migration to new contracts.

Overall, on-chain lending in crypto offers a new way for market participants to access liquidity and manage risk. With the use of smart contracts, which are self-executing contracts with the terms of the agreement written directly into the code, the process of lending and borrowing including the disbursement of loans and the collection of interest and collateral, are all automated without the need of trusted 3rd parties acting as intermediaries. This allows for a more efficient and decentralized lending market where borrowers and lenders can interact directly with one another, without having to know any of the counter-parties. This brings trust in a trustless system in that all of the rules and terms are dictated by a smart contract.

I hope you learned a little bit from this article and it has given you a little more confidence to dip your toes into the large defi pool and learn how they work. If you enjoyed this article, make sure to share and subscribe for more.