How On-Chain Lending Is Growing the Tezos Ecosystem

StableTech's Kevin Mehrabi on TezFin - Tezos' new on-chain lending platform, and what it means for the Tezos ecosystem.

1,300 words, 7 minute read

As Co-Founder of StableTech — one of the earliest decentralized finance development teams in the Tezos ecosystem, Kevin Mehrabi has had a front-row seat to the birth and ongoing growth of DeFi on Tezos.

With StableTech’s most recent offering freshly unleashed upon the Tezos ecosystem and its denizens, Kevin believes that puzzle may — at last — be nearing its completion.

To hear Kevin Mehrabi tell it, StableTech’s efforts to help enable decentralized finance in the Tezos ecosystem in earnest have focused on a few crucial areas since its team launched in 2020.

Now, with those crucial areas covered, the Tezos ecosystem stands poised to claim its rightful place at the bleeding edge of the larger decentralized finance conversation…

“We wanted to go after 3 key areas in a decentralized way: one was reserve-backed stablecoins — those are the most stable and scalable — so we started with USD Tez (USDtz) which was the first USD stablecoin on Tezos. We followed that with ETH Tez (ETHtz), which was the first wrapped ETH stablecoin on Tezos. TEZEX is the exchange — which we launched with the first-ever peer-to-peer cross-chain atomic swap bridge between Tezos and Ethereum. Soon we want to expand that to Bitcoin-to-Tezos swaps as well. After that — the one that took the longest time and was the most complicated — has been TezFin. That’s decentralized lending and borrowing. Those three areas are the key to scaling DeFi. You can’t scale DeFi without those 3 things. In particular, the keystone of the DeFi scaling arc is lending, which is why TezFin has been such a big deal for us.”

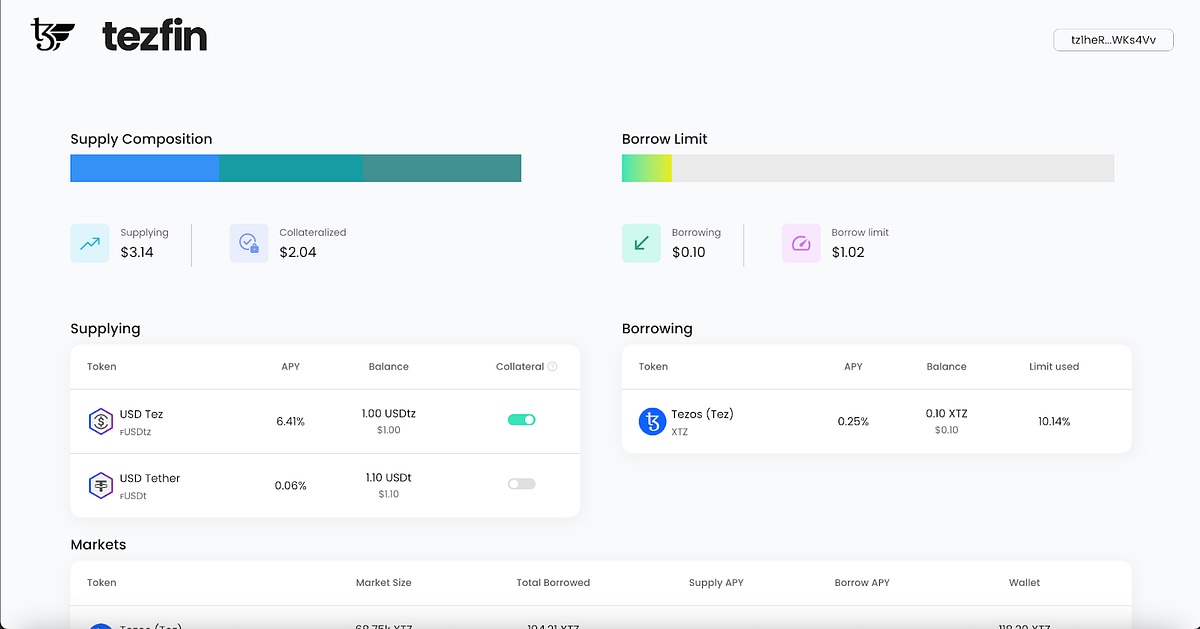

TezFin is a decentralized lending and borrowing protocol on the Tezos blockchain. Much like Aave and Compound, TezFin runs on lending pools, and automated interest-rate makers which dynamically adjust based on supply and demand.

TezFin lets users borrow against the collateral value of their assets, enabling a credit market in the ecosystem, which is conducive to any level of meaningful scale.

While the implications of TezFin for the larger Tezos ecosystem and its economy may not be immediately clear to the layman, folks like Kevin — who have been keeping a close eye on the growth of DeFi and its impact on ecosystems across the blockchain world for years — view it as much more than just another application.

On-chain lending, he believes, represents a viable, practical solution to one of decentralized finance’s most pressing problems — as well as offering an inroad to one of its most promising ecosystem growth opportunities.

“We were one of the first 2 exchange markets on Dexter (the first DEX on Tezos), so we were able to watch the very early growth of DeFi on Tezos in an organic manner. Within the next year, we had QuipuSwap and Plenty and Crunchy and SpicySwap — which brought yield farms into Tezos for the first time. This gave us perspective on both the strengths and weaknesses of the ‘additional incentive’ model and in part helped inform our choices going forward.

What those platforms did — especially Plenty, and credit is due there — is show that we can get $100 million into Tezos very quickly. You could just get it to show up if you put in the incentives. People will come here, and they’ll bring millions, potentially billions in liquidity with them. They will get a Tezos wallet. They will activate it. They will participate. Where the incentive is, that’s where they’ll go. There’s no friction there, contrary to what many people simply assume, without investigating. So getting liquidity in hasn’t been the issue. It’s retention that’s the issue.

The problem was, once those yield farm incentives ended, most of those who moved capital into Tezos would withdraw all their liquidity from the ecosystem. Many of these whales would ask “Is there a lending platform on Tezos?”; “Is there a place where I can park my funds, like Aave or Compound?” They were looking out for new opportunities, wanting to keep their money on hand. The answer, at the time, was “no, but we’re building it,” and so with no such option, they would just liquidate. So that $100 million in liquidity exited the ecosystem just as quickly as it came in.”

By offering an appealing wealth storage option to those with the ability (and demonstrated willingness) to bring capital into the Tezos ecosystem at scale, as well as in a way that can be recycled as borrowable capital, Kevin believes that TezFin holds the potential to cyclically compound enormous growth not only for Tezos DeFi, but for the Tezos ecosystem as a whole. And, perhaps even more importantly, to make that growth sustainable and keep the incoming capital here, something he spoke about [during his recent appearance on TezTalks Live]

“I think we’re going to have a surge in activity and participants. I think people will come and stay. I think people will start to see the capital they have in Tezos as a permanent fixture as opposed to maybe a fly-by-night opportunity. Now you can put Tez in a place where it’ll grow. You’ll grow with the price of it, and you will create for yourself a borrowing position. As the price of Tez goes up, so does your borrowing capacity.”

As a mechanism for sustainable DeFi growth, Kevin’s view is that on-chain lending isn’t just a piece of the puzzle, it’s the keystone of the decentralized finance arch. He describes on-chain lending as “an ecosystem imperative”, linking the ability to borrow, lend, and leverage one’s position/capital within any financial ecosystem to its very viability as a sustainable financial system…

“Given the role that lending plays in DeFi, and given the role that DeFi plays in an ecosystem and its economy overall, this is what’s needed to scale. If we can scale this up — not just the liquidity, because it’s one thing to have liquidity there and no one’s really participating — but to use this for borrowing, to use this to extend your position and your risk tolerance so that you can participate in the Tezos ecosystem in a way that you hadn’t before, that’s what leads to the overall growth of the lending markets, which leads to the sustainable growth of the DeFi markets. It’s all very much dependent upon the scaling apparatus that is lending. If our growth as an ecosystem is dependent on the growth and sustained scaling of DeFi, and the sustained scaling of DeFi is dependent on lending, that’s where we need to see this as an ecosystem imperative.”

Now, with TezFin’s production officially launched, it’s simply a matter of seeing how the Tezos ecosystem and those who could be enticed to enter and bring their capital to it respond. Viewed through Kevin’s lens, the days ahead could very well be booming with opportunities and growth, not just here in the Tezos ecosystem, but across the larger blockchain/DeFi space…

“We’re going to get to levels of liquidity, volume, and participation in DeFi in this coming cycle that are going to far outweigh anything that we’ve seen in the past. Tezos is right on that wave. We have all the pieces in place. This is that final thing that’s needed to get it all activated.”

Exactly what all this means for the continued, robust growth of the Tezos ecosystem remains to be seen. But, with talented folks like Kevin Mehrabi building out the underlying infrastructure of DeFi on Tezos and bringing impressive platforms like TezFin to life, all signs point to a very interesting 2024 for DeFi on Tezos indeed. Thank you Kevin for your wonderful insights and I can’t wait to watch the development of TezFin.