Pay up! Tezos NFT Payment Module Wert.io, And What it Means

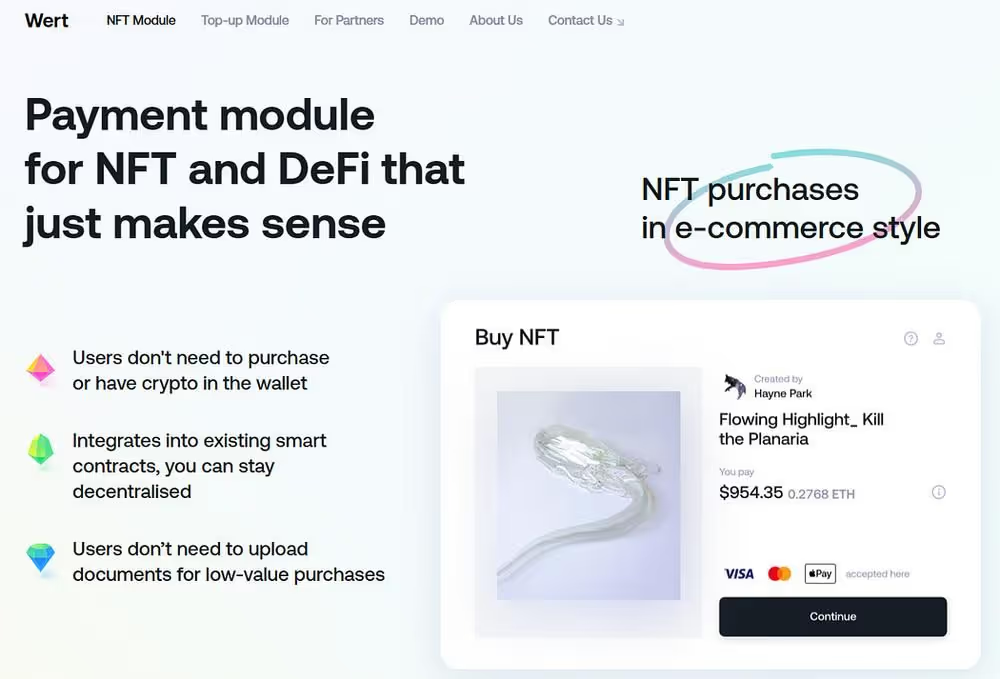

Wert’s mission is to enable seamless fiat and credit card purchases of digital assets by embedding a path to purchase widgets directly into blockchain applications.

8 minute read

Removing onboarding roadblocks and barriers to entry for new users is an important priority across the blockchain world — and for good reason! In the quest to bring blockchain technology toward its long-awaited mass-adoption moment, it just might be the most important priority there is.

From the earliest days of cryptocurrency - right through its meteoric rise to public prominence and mind-boggling market cap growth during the heady days of the 2017 boom and beyond, the question of how to most effectively bring new users (and their capital) into the larger blockchain ecosystem has been answered in many unconvincing forms. Centralized exchanges like Coinbase and Binance were able to leverage this gap in the market into positions at the very forefront of the cryptocurrency conversation — not to mention a healthy slice of the sweet, sweet blockchain capital pie. The result: a speculative cryptocurrency ecosystem where those who are actually building the applications of tomorrow could very easily be left out in the cold completely. According to Wert.io Co-Founder George Basiladze, this was a pressing industry-wide problem that needed solving, and he and his team had a concept in mind for doing exactly that… Here’s what George had to say:

“If everything’s going to be non-custodian and decentralized, people are going to need a lot of crypto. The best way to buy that crypto is not on a centralized exchange, it’s right in the application, whether it’s a DeFi protocol, or dApp, or wallet. The interesting thing is that many wallets had no credit card capability until very recently. They were referring their clients to big exchanges. Those users were doing KYC, inputting their personal details, and buying crypto all on the exchanges, and they weren’t coming back! Every application was relying on monopolies for user onboarding. We thought that if you give them credit card and fiat purchasing capabilities as a service that could be embedded into the application and work independently, this would give all those wallets and developers independence. That was the whole idea: to help them onboard users without third parties.”

If the developers building a blockchain application are selling digital assets as a vehicle to financing their project (which they often do), and folks are interested in purchasing those digital assets as a vehicle to participating in those applications (which they hopefully are), those folks need to be able to use their money to do so. For those of us already participating in the larger blockchain ecosystem, this process is relatively simple. For those who are newly entering this space, however, the task of moving one’s money into the blockchain space can be (and often is) a daunting one.

While centralized exchanges have played a part in facilitating this process, their processes have presented some challenges of their own. First, the onboarding and KYC processes on many exchanges are onerous and difficult to navigate — particularly for those new to the space. Second, as George alluded to above, such exchanges are, effectively, ecosystems all of their own. By the time a user has gone through the centralized exchange onboarding process and been presented with a cornucopia of options within that exchange, they may have lost all interest in the application which brought them into the blockchain space in the first place. For the developers attracting consumers to blockchain technology with innovative and interesting applications, that’s far from ideal.

Enter Wert.io.

Wert’s mission is to enable seamless fiat and credit card purchases of digital assets by embedding a path to purchase widgets directly into blockchain applications. In this way, Wert empowers developers to work directly with the users of their applications, while also empowering those looking to get involved in a particular application without dealing with a centralized exchange.

While this is a laudable development, particularly for those bootstrapping new applications, it’s not the Wert team’s ultimate vision. According to Geroge Basiladze, Wert has a lot more in mind here.

“We understood that just buying cryptocurrency is not the end goal. It cannot be the end goal. People should be able to buy crypto to use it somewhere. With NFT Checkout, we’ve developed software that is integrated in a very similar manner which allows consumers to buy any NFT that is deployed on chain. It interacts directly with the smart contract, be it in a marketplace or during a mint. We let consumers pay with fiat currency or credit cards, and once there’s a successful transaction, we use our liquidity pool to deposit the right amount of tez into the smart contract using the call details provided by the marketplace or creator.”

The days of ICOs and token sales as the sole financing mechanisms for new and emerging blockchain projects are now behind us. The NFT has, to a large extent, supplanted them as a key digital asset being traded to finance the development of applications in the blockchain realm.

Here in the Tezos ecosystem, where digital art and gaming have emerged as important drivers in the race toward the Web 3.0-enabled future to come, Wert’s capacity to streamline the purchase process for these crucial digital assets is not one which should be taken lightly.

To hear George Basiladze tell it, the desire to build a collaboration between the Tezos Foundation and the Wert.io team was more than just a little bit mutual…

“We wanted to work with the Tezos Foundation, and we wanted to work for the Tezos community. There’s so much value in the system and in the network, and it’s so undervalued that it sometimes hurts. We wanted to support that.”

The Tezos ecosystem is making marked progress in its journey to claim a prominent place at the Web 3.0 table. Tezos is about to activate its 13th protocol upgrade dubbed “Mumbai”, which has been approved through the Tezos governance process, and is currently undergoing the adoption phase in the governance process. Blockchain-based games like Dogami and Emergents are bringing new users into the space, and Tezos’ digital art community and NFT marketplaces are very much thriving.

The journey to a Web 3.0-enabled world, however, has only just begun. Consumer misperceptions about blockchain technology, cryptocurrency, and NFTs remain a significant hurdle. The transition away from the Web 2.0 reality of the day will be fraught with speedbumps at every turn, and the media machine continues to loudly push negative narratives in the service of vested interests intent on maintaining control of the digital realm.

Wert.io’s model is built around the idea that the Web 2.0 experiences consumers are used to/comfortable which can (and should) be duplicated right here in the Web 3.0 arena. Easing audiences in to the Web 3.0 paradigm and the Tezos-powered applications being built within it is the key to driving adoption in the days ahead. For George and the Wert.io team, making this transition as smooth and seamless as possible is THE goal…

“In order to make the whole experience seamless, people shouldn’t need to be fully aware of what is happening and all the technicalities when they do their first transaction. There should be a learning curve. When you buy an NFT with a card, it’s a very good way to learn about blockchain and cryptocurrencies without all the KYC processes and private keys and stuff. Once you own it, then you can learn about how it works. You shouldn’t need to be an expert to do your first transaction. You just want to buy an NFT. Why should you need to understand everything?”

While roadblocks to widespread consumer understanding, acceptance, and (most importantly) adoption of blockchain technology remain, the Tezos ecosystem is laser-focused on smoothing them out, one-by-one. With tools like Wert.io and innovators like George Basiladze supporting the Tezos ecosystem, it’s a safe bet that these once disruptive roadblocks will soon be things of the past.

And frankly, that’s the way it should be.