Stake and (L)earn: A Beginner’s Guide to the New Tezos Staker Role

What is the new Tezos Staker role? How can I become a staker and should I become one in the first place? Well, keep reading to find out!

8 minute read

In the latest and one of the most significant upgrades of the Tezos protocol, known as ParisB, a new staking role has been introduced. This new role has left many people puzzled about what it is, how it functions, and how it differs from the previous staking mechanism.

In this article, I will break down everything you need to know about the new staker role in simple terms and guide you through the process of becoming a staker yourself. Trust me, it’s not as complicated as it might seem. But to fully grasp this new staking role, we first need to understand how Tezos staking worked up until now. Ready? Let’s dive in!

Staking options before adaptive issuance. #

As many of you know, until recently, Tezos offered two main options for staking: Baking and Delegating.

- As a baker (validator), you need to run the appropriate software and maintain a staking balance of at least 6,000 tez. When baking, your role involves creating and verifying blocks. To ensure the security of the network, you are required to lock your tez as security bonds for a specific period. This measure helps secure the chain, as any fraudulent attempts (i.e. double baking a block) result in penalties, where the offender loses a portion of their security bonds (a process known as slashing). However, it’s important to note that if you run the software as suggested and avoid any fraudulent activities, the risk of slashing is virtually close to zero. For each block you create or verify, you receive rewards directly from the protocol.

- As a delegator, you can delegate your tez baking rights to another baker, increasing their staking balance and helping them secure more blocks, which translates to more rewards. From these additional rewards earned through your baking rights, the baker retains a small portion as a fee and sends the rest to you. When you delegate, your tez remain in your wallet and are always liquid (no locking), ensuring zero risk for you. However, this also means you do not directly contribute to the chain’s security.

The new “Staker” role — Best of both worlds. #

Until the recent ParisB upgrade and the activation of adaptive issuance, Tezos had two staking options: being a baker or a delegator. Now, a third role has been introduced, known as “Staker,” which combines traits of both bakers and delegators.

As a Staker, you choose to stake your coins with another baker. Your tez remain in your wallet but are locked, and if you decide to unstake them, you will need to wait 4 cycles (approximately ~11 days) for them to become liquid again. When staking, your tez actively participates in the chain’s security just like a baker, which also means that there is a tiny risk of slashing if your baker misbehaves (more on slashing in the next section).

Despite this minimal risk, staking offers double the rewards compared to delegating. These rewards are sent directly to stakers from the protocol, eliminating the need to rely on the baker to distribute them. You can also stake just a portion of your wallet while the rest of your tez remain delegated and liquid. For instance, if you have 100 tez in your wallet, you can choose to stake 60 tez while the remaining 40 tez will be delegated and stay liquid.

Think of the staker role as a way to enjoy the benefits of baking without the hassle of maintaining hardware or running software. Essentially, you are co-baking with another baker using their setup, all while retaining full ownership of your funds.

The boogeyman: Slashing #

Before we dive into the details of how to start staking, there’s an important point to address: slashing. Many tez holders are hesitant to try the new staker role due to concerns about the risk of slashing. Let’s take a look at some facts about slashing.

Since the start of the Tezos mainnet, over 5.9 million blocks have been created, and slashing has occurred in only 0.003% of them (Slashing cases sources: 1, 2, 3). Slashing doesn’t happen if your baker’s internet or power goes down. To have their deposit slashed, a baker must commit “double signing,” such as running two setups and attempting to bake or attest the same block from both instances.

To paraphrase one of the core developers in one of our conversations on the matter: “It is hard to double bake unless you really want to or have some custom setup and you mess up.” Without getting too technical, slashing is a very rare event. If a baker uses the baking software as recommended (as most do), the risk is virtually zero.

With all that out of the way, and now that we’ve established how minimal the risk of slashing is, let’s explore how to get started with this new staking role, beginning with selecting a baker.

Select a Baker #

The first step is to choose a baker with whom to stake. Not all bakers accept external staking from other users, so it’s crucial to find one that does. You can start by checking if the baker you’re currently delegated to accepts stakers. To find suitable bakers, you can visit xtzchad.xyz, a community-built tool that provides a comprehensive list of bakers who have enabled external staking.

This tool also shows how much free space each baker has (ensure they have enough capacity for the amount you want to stake) and their associated fees. Just as with delegating, my advice would be to choose a baker who is active in the community and easy to contact (telegram, X, email, etc.) and ask questions when and if needed.

Delegate -> Stake -> Earn #

Once we have chosen the baker we want to stake with, it’s time to proceed with staking. While some Tezos wallets have a built-in staking button, in this guide, I will show you how to do it using universal options that work with any Tezos wallet.

We have two primary options:

- gov.tez.capital— Created by TezCapital

- stake.tezos.com — Created by Trilitech

Both options follow a similar process, so to keep this guide concise, I will demonstrate using gov.tez.capital. However, feel free to use either option based on your preference. Let’s dive into the steps.

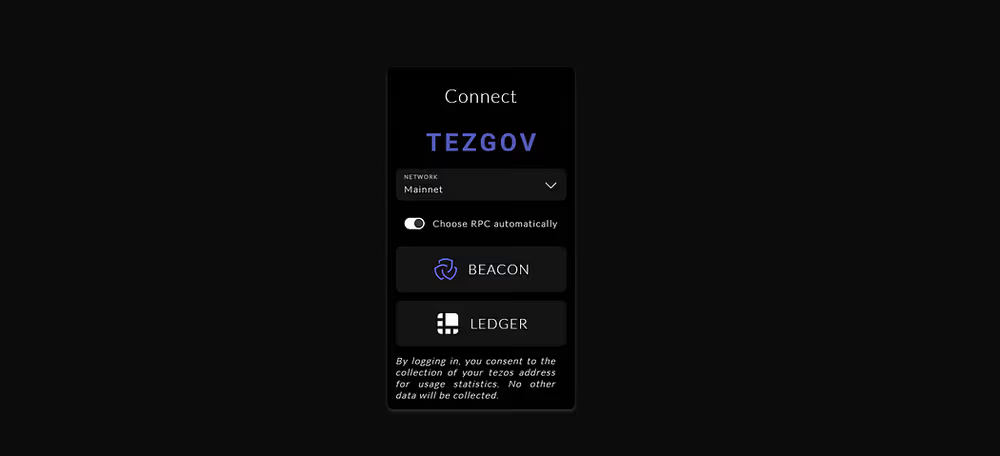

Step 1 — Connect your wallet #

The process is quite straightforward. If you are using wallets like Kukai, Temple, Trust Wallet, etc., simply click on the “Beacon” option. If you are using a Ledger device*, click on the “Ledger” icon and connect your device.

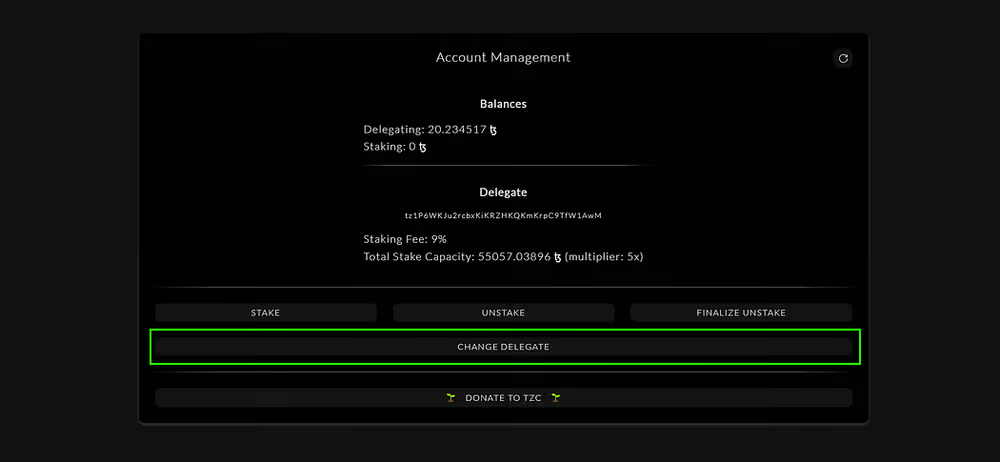

Step 2- (re)Delegate to a baker #

Before we can stake our tez with a baker we first need to delegate to him. If you are already delegated to the baker you are going to stake with, you can skip this step. If not, click on the “Change Delegate” button, paste the baker’s address, click delegate, and confirm the transaction with your wallet.

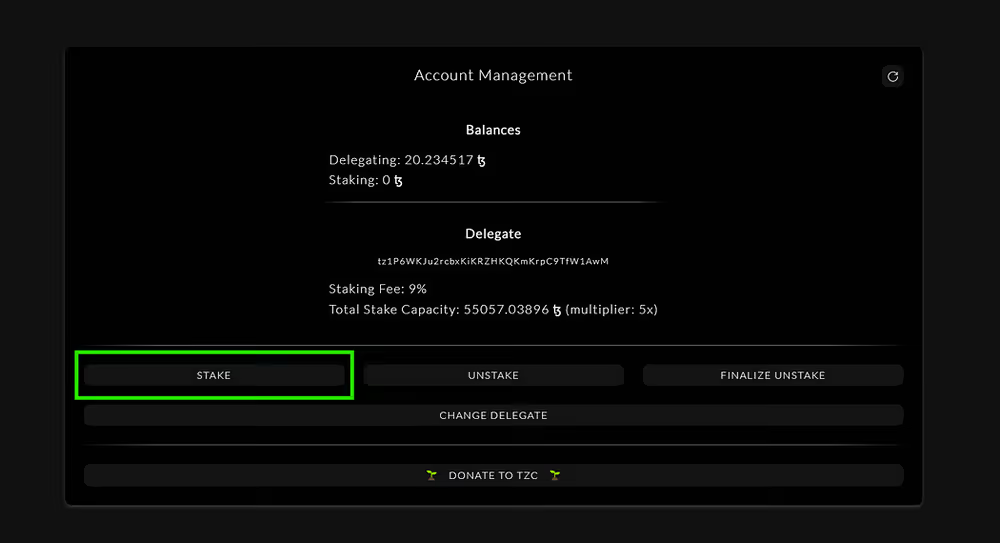

Step 3 — Stake and earn! #

We are almost done! Now that we’ve delegated to the baker of our choice, it’s time to stake. Click on the “Stake” button, choose the amount of tez you want to stake (you can stake just a portion of your wallet, leaving the rest delegated and liquid), and confirm the transaction with your wallet. That’s it! Your tez are now staked, and you will start earning more rewards for as long as you keep them staked.

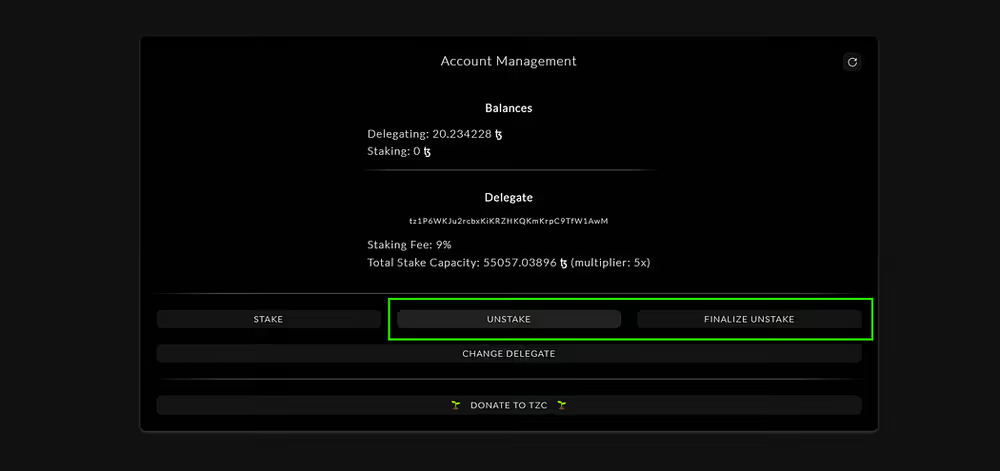

Remember, when you decide to unstake, your tez will remain locked for 4 cycles (approximately 11 days) before you can finalize the unstaking process and they become liquid again. You can do both actions using the “Unstake” and “Finalize Unstake” buttons respectively.

And that wraps it up! Starting staking is incredibly straightforward, and with benefits like doubled rewards compared to delegation and increased network security, staking becomes an obvious choice — especially if you’re holding Tezos for the long haul, like me.

I’ve covered as much as possible about the new Staker role while trying to keep it concise. If you have more points to discuss, feel free to drop them in the comments below. For additional queries, join the Tezos Telegram or Discord communities where you can get real-time answers. Happy staking!