Synthetics on Tezos

A closer look at the synthetic token platforms and assets on Tezos.

Originally published at Tezos Commons News

750 words, 4 minute read

With the topics of lending and Dex aggregators on Tezos covered in previous articles, it’s time to look at another popular category of platforms in the Tezos Defi ecosystem. In this article we will look into some of the synthetic token platforms and assets on Tezos and how they work.

Remember to always do your own research as this article is meant to be informative only and not a financial advice or stamp of approval.

How do crypto synthetics work? #

Crypto synthetic assets are digital tokens that simulate the price of an underlying asset or financial instrument. They are created through decentralized platforms and are designed to track the value of an asset (can be both physical or digital assets) without requiring the holder to physically own or control the underlying asset.

The process usually requires you to lock other asset(s) as collateral and then mint the synthetic token which through the economic rules of the smart contracts, are designed to follow the value of the asset they were created for.

These synthetic assets allow traders and investors to get exposure to specific assets ( or a “basket” of assets) without actually holding them in their portfolio. Also, through these platforms, people can open leveraged positions onchain without the need of a centralized exchange. Let’s take a look at some such platforms and assets on Tezos.

Synthetic assets platforms on Tezos #

Kolibri.finance (KolibriDAO) is a platform where people can mint the kUSD stablecoin which is designed to follow the value of the US dollar.

Users can deposit tez into their personal ovens as collateral, and then mint a specific amount of kUSD (depending on your collateral’s value) to open positions on other assets or use them in possible opportunities that have showed up, while still having exposure to their collateral asset (tez).

With such incentives and by using the interest rate, liquidations, and other similar tools, kUSD is designed to be pegged to the US dollar so traders can swap on-chain to kUSD whenever they want to get exposure to USD without having to go through a centralized exchange.

Youves is one of the most popular defi platforms on Tezos and for a good reason. In a similar way to Kolibri, users of Youves can create and also trade various synthetic assets like uBTC, uUSD, uXTZ and even uDEFi which is an index of 4 different defi assets (AAVE, CAKE, LINK and UNI).

Also, the fact you can use various assets like tez, USDt, tzBTC or even SIRS for collateral, allows for more complicated and interesting trading moves for those who seek them. For those of you who do not, you can always just swap to one of their synthetic assets if you are looking for an easy way to get exposure on them.

For a more in-depth look on Youves, check out William McKenzie’s “Exploring Youves: Tezos DeFi is Starting to Heat up” article!

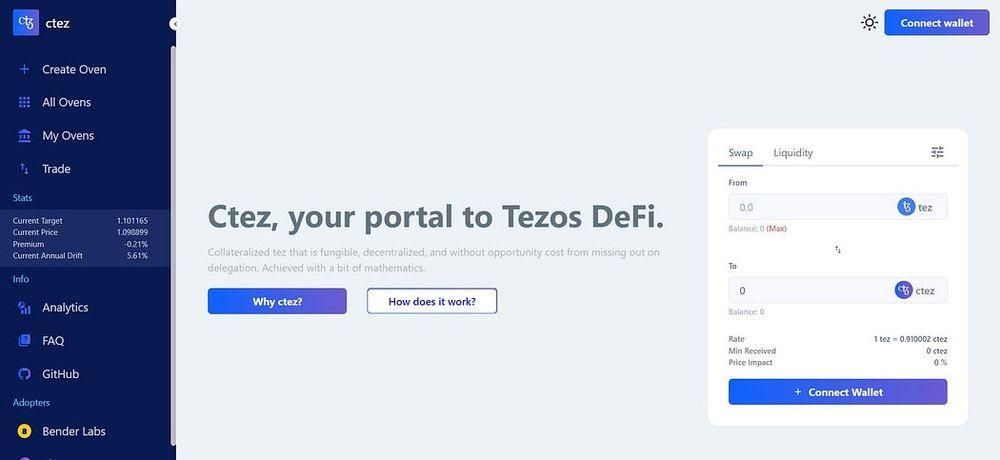

cTez is a synthetic asset that is designed to algorithmically follow the value of tez along with the staking rewards it would produce over time.

Users can use cTez instead of tez in defi platforms without having to worry about the staking rewards. To mint it, in a similar way to Kolibri, you need to open a personal oven and deposit tez as collateral and depending on the market conditions you could use that to open leveraged positions.

As the cTez economic mechanisms are more complicated, you can read my article on “CTez Explained!” to better understand how it works.

Synthetic asset platforms have emerged as a powerful tool in the world of cryptocurrency, offering people access to a wide range of assets without the need for direct ownership. As with any new technology, there are still risks, however, with the continued development and maturation of these platforms, it is likely that synthetic assets will play an increasingly important role in the future of defi.

For people interested in exploring synthetic assets on Tezos, it is important to carefully research each platform and their economic mechanisms and understand the risks associated with such assets. With the right approach and mindset, synthetic asset trading can be a powerful way to diversify one’s portfolio and gain exposure (even leveraged if someone wants to) to a wide range of assets.