Tezos DeFi in 2022: The Current State of P2P Lending & Borrowing

2022 has seen a new cohort of DeFi applications on the Tezos blockchain, with the emergence of three peer-to-peer (P2P) lending and borrowing protocols.

1,800 words, 9 minute read

Photo by micheile dot com / Unsplash

Editorial note: The following article contains discussion of Decentralized Finance (DeFi). DeFi refers to a relatively new financial system based on blockchain, that decentralizes the infrastructure, processes, and technologies used in traditional financial transactions. As such, when it comes to DeFi, the regulatory framework that exists around traditional finance is incomplete and evolving. It is important that readers do their own research, and understand that coverage of DeFi products and services on Spotlight does not constitute endorsement by either the Spotlight editorial board, Blokhaus Inc, or any affiliated organizations.**

- was an exciting and active year of development on the Tezos blockchain. Of course it was the first year that Tezos ‘clean NFTs’ really took off, but it was also an important year for the development of DeFi protocols on Tezos.

During that time, the Tezos ecosystem saw synthetic assets, algorithmic stable coins, CDPs, yield farms, staking, up to six active decentralized exchanges/AMMs, decentralized limit orders, various financial tool kits, and much more. One of things that was missing, however, was P2P lending and borrowing - a type of protocol that we might expect to see on this list. But things have changed since then. So far in 2022, the Tezos ecosystem has seen the launch of at least three P2P lending/borrowing protocols, including: Yupana.finance, Kord.fi, and Tezos Finance (or TezFin).

Traditional Lending & Borrowing #

Photo by Ibrahim Boran / Unsplash

The concept of peer-to-peer lending/borrowing is simple, and it can be understood by comparing it to the way that loans and debt-repayment work in the traditional financial system.

In the traditional finance world, when someone needs a loan, they go to a banking institution. The money borrowed is expected to be paid back with interest, and it’s the interest which, in effect, comprises the fee levied by the institution on the end user. Interest is thus what makes lending/borrowing a lucrative business model for banks.

A portion of this interest is paid back to the person that provided the money that was lent out in the first place, i.e. those who put their money in a savings account with the bank, and then of course the bank itself takes a portion of the interest for providing the service.

The traditional lending and borrowing system via banks is a way to mobilize otherwise stationary capital

It is important to note here that in this traditional example, the bank takes money from customers who aren’t using it (savers with accounts at the bank) and loans it to someone who needs it (the borrower). The traditional lending and borrowing system via banks is thus a way to mobilize otherwise stationary capital, and this is how people who save their money in a savings account earn interest on their savings - they are effectively granting the bank permission to loan it out to other people, who then pay that loan back with an additional fee tacked on.

Credit System & Interest Rates

One benefit of being a borrower in the legacy financial system is that because it utilizes a credit system, you can take out a personal loan without putting up any collateral to insure your debt. However, personal loans usually result in higher interest rates for the borrower because there is always the risk that the borrower goes bankrupt, in which case the bank loses money.

Unfortunately, this doesn’t equate to higher interest rates paid back to lenders. Part of the reason for that has to do with the ‘middle man’ role that the banks play in providing a service and the risks that are associated with it, as mentioned above. This means that the higher interest paid on, for example, a personal loan typically goes to the banks in the form of a service fee. Not to mention, banks have to pay taxes on their cut since it qualifies as part of their income - this can account for at least some of the discrepancy between the amount kept by the bank, compared to what is paid to the lending saver.

Unlike legacy finance, there is currently no equivalent of a credit system in the crypto world, so all loans must be collateralized as a way to insure a user’s debt

As we will see below, the tradeoff with decentralized crypto lending and borrowing is that, unlike legacy finance, there is currently no equivalent of a credit system in the crypto world, so all loans must be collateralized as a way to insure a user’s debt, and to ensure that interest can be paid back to any borrower or borrowing mechanism. However, because decentralized systems can be genuinely peer-to-peer (P2P), effectively cutting out the ‘middle man’ role, interest rates paid back to lenders tend to be much higher.

Decentralized Lending & Borrowing #

Photo by Kanchanara / Unsplash

Unlike traditional finance, which utilizes banking institutions as intermediaries, in the world of cryptocurrencies, lending and borrowing services can be facilitated through smart contracts, effectively cutting out the ‘middle-man’, and replacing traditional banking mechanisms with software.

In certain respects, this makes crypto lending and borrowing solutions more efficient, and it allows for genuine P2P models. What this means is that people who have funds to ‘save’, i.e. funds that they would have sitting around in a savings account anyway, can put their crypto to work by depositing it in a lending contract that others can then come and borrow from.

Just as in the traditional model, the loans that are taken out come with specific interest rates, and when they are paid back, the interest is accrued directly on the capital that was provided by the borrower. And because there is no ‘middle-man’, the interest rates offered through P2P crypto lending protocols, which get paid back to lenders, are often far more competitive than traditional bank loans. There also is the fact that a software cannot itself make an income, thus the protocols do not in practice have to account for taxes. It is worth noting however that users who participate in decentralized lending and borrowing may still themselves be subject to certain tax obligations.

There are two slightly different ways that lending/borrowing can take place in crypto - synthetic asset borrowing and P2P asset borrowing. For the sake of simplicity, we’re assuming a US-based process, as detailed below.

Synthetic Asset Borrowing

Previously (in 2021), the only kind of borrowing that was possible on Tezos was via the creation of synthetic stablecoins. In this model, the borrower creates a collateralized debt position (CDP) by putting tez in a vault as collateral, and then a synthetic stablecoin is borrowed against it. How much one is able to borrow, and the price at which one’s collateral becomes liquidateable, is determined by a dynamic loan-to-value ratio. These loan-to-value ratios fluctuate as price oracles track the market value of the collateral denominated in US dollars.

Synthetic asset CDPs are very useful in DeFi because the asset being borrowed is always available, so long as one has the tez to put up as collateral, and it is a reliably stable way to borrow money since the assets algorithmically hold a soft peg to the US dollar. But though always available, one could argue that a draw back to synthetic borrowing is that they are limited in kind of asset that can be made available. They also don’t necessarily expand the pool of opportunity for DeFi users to lend their station assets and thus earn yield from borrowers directly.

Peer-to-peer Lending & Borrowing

Now, thanks to the likes of new applications like Yupana.finance, Kord.fi, and Tezos.finance, it is possible for Tezos DeFi users to put their money to work in a P2P lending pool. Such pools rival interest rates earned on a traditional savings account; they help to expand the liquidity of assets available to borrow on Tezos; they don’t rely on synthetic assets per se; and they expand opportunities for DeFi users who wish to put their money to work and earn additional yield by becoming lenders.

Much like the CDP mechanism of synthetic asset borrowing described above, P2P protocols allow users to borrow assets by putting up collateral. One of the main differences, however, is that assets that are being borrowed are not synthetically minted, but rather they are provided by other end users, thus expanding the pool of assets available to be borrowed.

Of course one tradeoff here is that interest rates may vary depending on supply and demand principles, and it is always possible that there may not be enough liquidity provided by lenders to cover the kind of loan a user might wish to take out. But P2P protocols do expand the pool of assets that can be made available to borrowers, and they make it easy to put up a variety of assets as collateral for taking a loan on the side of the borrower.

One thing worth mentioning, again, is that although current tax laws may not apply squarely to P2P lending protocols themselves, as they do in the case of banking institutions, tax laws may still apply to users of P2P protocols. It is important to do your own research into what tax laws may apply to you when using such platforms.

Below is a list of 3 P2P lending protocols that have been introduced on the Tezos blockchain in 2022. Though Yupana, Kord, and TezFin, as mentioned above, are all P2P lending and borrowing protocols, the details of each platform, such as the interest rates, mechanisms for leveraging and generating yield, or the assets that are supported, may vary.

Yupana.finance #

Yupana was created by Madfish Solutions, the team behind Temple Wallet and the QuipuSwap DEX. This platform has an external audit.

Assets currently supported:

- TEZ

- CTEZ

- KUSD

- UUSD

- TZBTC

- UBTC

Links: #

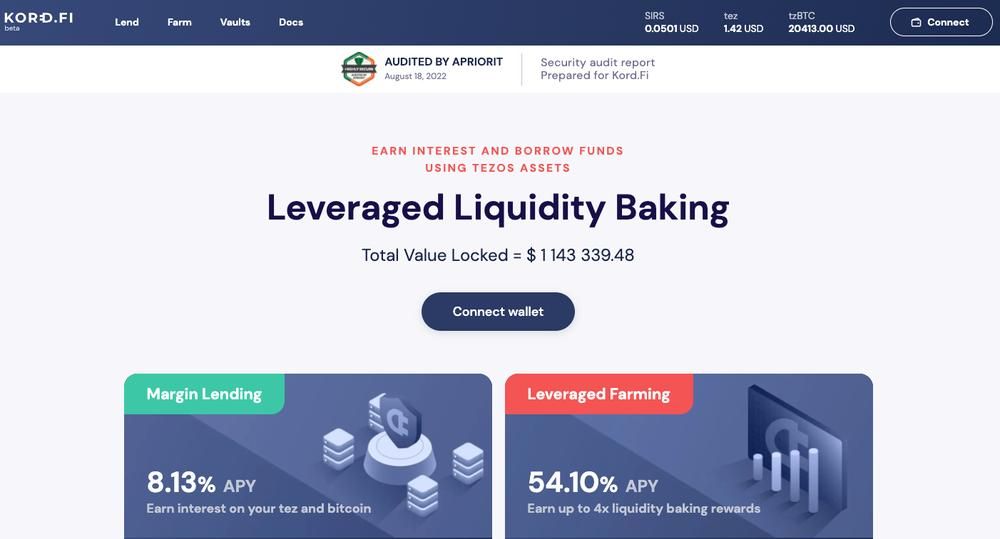

Kord.fi #

Kord offers leveraged liquidity baking, leveraged farming, and margin lending. The platform has an external audit.

Assets currently supported:

- TEZ

- TZBTC

- SIRS (Liquidity baking token)

Links: #

Tezos Finance #

Tezos Finance (TezFin) is a StableTech product backed by DraperGorenHolm. No formal audit has been conducted on TezFin as of the time of this article’s publication.

Assets currently supported:

- TEZ

- USDtz

- BTCtz

- ETHtz