Tezos in Q2 2025: A Chain in Transition

Through the Lens of Messari's Latest Report

5 minute read

Messari’s Q2 2025 State of Tezos report offers a clear snapshot of a blockchain at a turning point. The data reveals an ecosystem where the center of activity is shifting from Layer 1 to Etherlink, where core upgrades are reshaping the protocol’s foundations, and where adoption is outpacing valuation in a way the markets haven’t yet priced in.

Rather than recap every chart and figure, let’s look at the story those numbers are really telling.

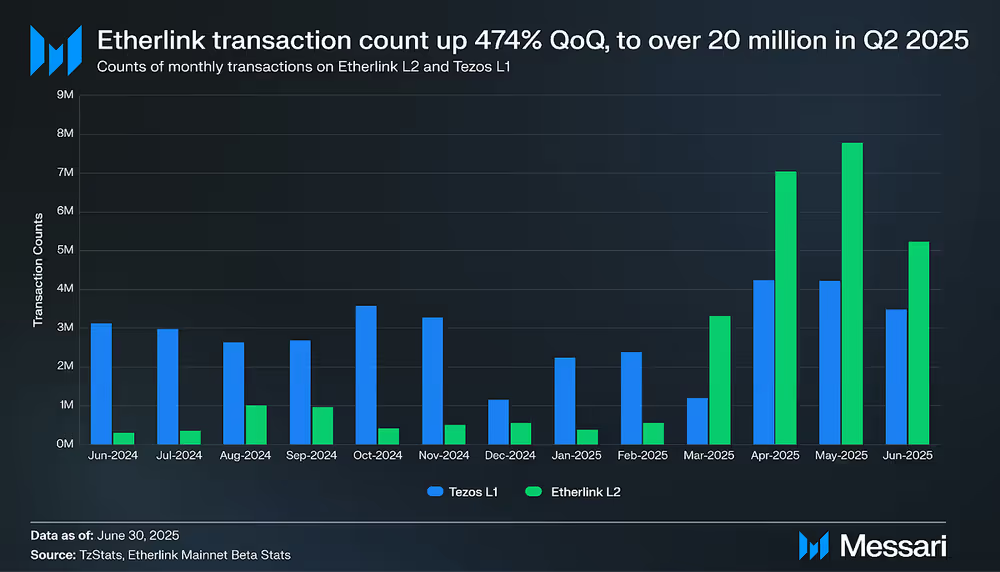

Etherlink’s Explosive Growth #

Source: Messari Report

Source: Messari Report

The standout story of Q2 was Etherlink. Messari reports more than 20.5 million transactions on the rollup, a 474% increase from Q1, with fees and contract deployments following the same trajectory. Etherlink now accounts for nearly three-quarters of total network fees, and smart contract deployments soared from just 806 in Q1 to over 203,000 in Q2.

I think we can agree that these numbers aren’t random spikes, they reflect a deliberate strategy. Most new integrations, liquidity programs, and incentives are being launched directly on Etherlink because it represents the future of Tezos’ scaling, the first runtime of the canonical rollup model. For most users and developers, it’s the natural place to build with faster execution, lower costs, and most importantly, compatibility with tools they already know.

The Work on L1 #

But this doesn’t mean the L1 is being left behind. On the contrary, the base layer is where some of the most important technical work is happening, laying the foundation that makes the Tezos X vision possible.

Messari highlights the Rio upgrade, which shortened cycle times from three days to one, giving bakers and stakers more agility. It also tightened validator rules and introduced better incentives for participation in the Data Availability Layer. Add to that the announcement of RISC-V rollups, and you can see how the protocol is positioning itself for a modular future, where L1 acts as a secure settlement and governance layer while rollups handle execution.

I think this side of the story often gets overlooked, without the L1 doing the heavy lifting, Tezos X wouldn’t be possible. Lastly, I want to note that even with Etherlink drawing the headlines, L1 DeFi grew nearly 46% in XTZ terms in Q2, showing that activity on Tezos isn’t simply abandoning the base chain, it’s diversifying across layers.

Ecosystem Momentum #

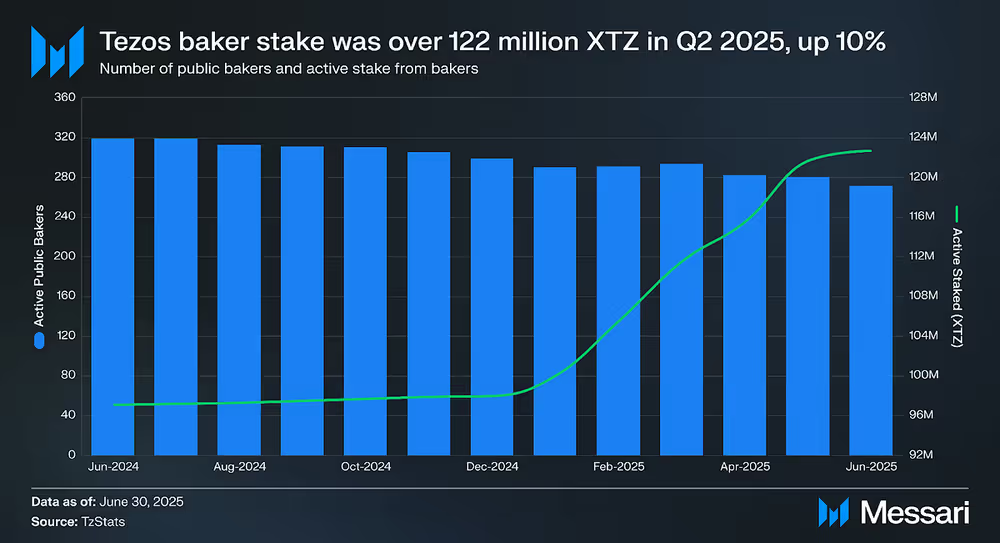

Source: Messari Report

Source: Messari Report

Messari’s report also highlights that activity on Tezos is broadening, not narrowing. On L1, monthly transactions and contract calls rose 63% quarter-over-quarter to nearly 4 million, showing that even as Etherlink accelerates, the base chain continues to see steady developer and user activity.

Validator (aka Bakers) participation tells a similar story. While the number of public bakers dipped by about 7.5%, the active stake grew by nearly 10%. Part of this shift comes from the introduction of the new staker role, which allows anyone to lock their tez directly to a baker without running validator infrastructure. To me, this kind of shows that the network is becoming more inclusive, participation is opening up even as validators consolidate.

Taken together, these details show an ecosystem in motion. Contracts firing on L1, a broader base of participants joining through staking, and Etherlink capturing new growth on top.

Reading Between the Lines #

Put together, Messari’s data tells a bigger story than quarterly numbers. Tezos X is already in motion**.** Execution is shifting to L2, where Etherlink leads the way today, but it won’t be alone for long. Runtimes like TezLink and JSTZ will soon join it, creating a modular rollup ecosystem with Tezos L1 as the secure anchor beneath it all.

The irony is that even as this transition takes shape, Messari notes that Tezos’ market cap fell nearly 18% in Q2. So while activity and infrastructure are accelerating, sentiment hasn’t caught up yet. But for those of us paying attention, the signal is clear: the pieces of Tezos’ long-term vision (Tezos X) are locking into place.

If you want to look deeper into the numbers and charts behind this analysis, you can read Messari’s full report here.