Tezos 'Inflation Funding' Mechanism

What is it? Why does it exist? The inflation funding process is like an extra feature of the on-chain governance process of Tezos.

Originally published at Tezos Commons News

1,100 words, 6 minute read

Tezos has a lot of great technological features like the “liquid staking through delegation” feature, the “on-chain governance” feature, the ability to formally verify your code, and many more that most people have heard about but are mostly aware of, especially in the mechanics of how they work.

There is another great feature that is lesser known and which I believe in the long run, will heavily contribute to Tezos’ longevity. In this article I will explore what Tezos’ “inflation funding” mechanism is, how it works, what its benefits are, and look at some examples where it has been used in the past.

Inflation Funding Mechanism #

The inflation funding mechanism of Tezos is a tool that allows the Tezos protocol itself to fund developers by creating newly minted tez (inflation) to pay them. The inflation funding process is like an extra feature of the on-chain governance process of Tezos.

If you are familiar with the Tezos’ on-chain governance process, you know that any baker (validator) is able to inject a proposal for the network’s upgrade. These proposals, can also have an invoice for a specific amount of tez attached to them and if the proposal gets voted in and implemented, the protocol itself mints the amount of tez asked in the invoice and sends them to the address included in the invoice.

This mechanism brings a lot of benefits and potential so let’s take a look at some of them.

- Decentralized decision-making:

Since the invoices are attached to the protocol upgrade proposals, they have to go through the voting process of Tezos’ on-chain governance. This means that the whole community can decide which invoices and proposals are worthy to be funded and which are not. - Aligns incentives:

The inflation funding mechanism aligns incentives between developers, users, and holders of tez. Developers are incentivized to propose and work on projects and features that align with the interests of the community, and users and holders are incentivized to vote for proposals that align with their own interests. For example if the community is really against a specific feature, developers will not work on that feature as they know that it probably won’t be voted and implemented so they won’t get paid. Instead they will work more on features that the community is often asking and have more chances to get voted and implemented. - Continuous funding:

The on-chain funding mechanism provides a potential continuous source of funding for development and other initiatives that is not reliant on a specific entity like the Tezos Foundation. This allows for long-term planning and sustainable growth of the Tezos ecosystem without being completely reliant on the Tezos Foundation. - Transparency:

The funds allocated through the inflation funding mechanism are tracked on the Tezos blockchain, making the process transparent and auditable. There are no surprises. - Flexibility:

The system allows for a wide range of proposals to be submitted, from technical development and research, to community building and education. Although so far the invoices that have been included in proposals were for protocol development features, people are able to attach invoices for other use cases as well as long as they make sense for the community to vote for them. - Better coordination:

It can help to mitigate the coordination problem that is often found in open-source projects, by providing a mechanism for the community to fund and prioritize development efforts.

Examples #

The Tezos Foundation’s main goal is to promote and grow the Tezos ecosystem and although most of core developing funding (and not only) has been through them, in some instances, and especially in the most recent upgrades, we have seen the inflation funding mechanism put to actual use. So let’s take a look at some example upgrades that have an invoice attached to them!

- Athens Upgrade

Athens was the first ever Tezos upgrade that was proposed by Nomadic Labs. In the proposal, an ceremonial invoice for 100tez was included (from all accounts, the tez was put to good use in that it bought the team some tacos!). - Babylon Upgrade

Babylon, which was the second upgrade of Tezos, also had an invoice of 500tez attached which was sent to a multisig wallet.

Note: The tez from the invoices in the Athens and Babylon upgrades were symbolic amounts and the invoices were mostly added as proof of concept for the inflation funding mechanism. Plus, they were destined for a great use!

Full Nomadic labs’ Babylon blog post

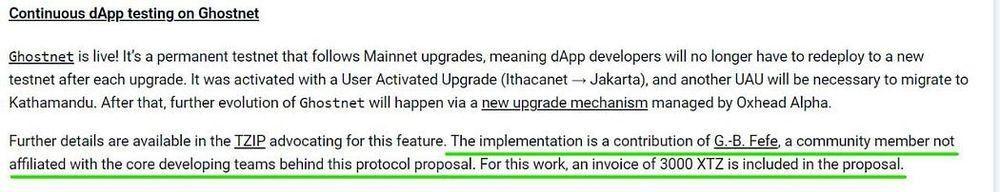

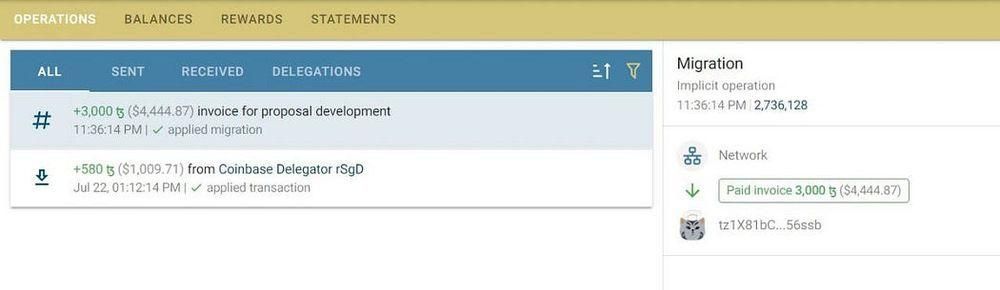

- Kathmandu Upgrade

The Kathmandu upgrade, was the first time the “inflation funding” mechanism was used to actually reward development work that was done by an anonymous community member (G.-B Fefe) not affiliated with the core developing teams!

Note that there was another invoice paid to an external contributor in the Florence upgrade which was before Kathmandu so you could say that technically that was the first real use of the Inflation funding feature, but the amount paid was again a symbolic one (100 tez) so I posit that Kathmandu as a better example of a first time real usage of this feature.

- Lima Upgrade

Right after Kathmandu, we saw Lima (the 12th Tezos upgrade) also containing an invoice to reward work from external contributors.

Overall, Tezos’ “inflation funding” mechanism is an innovative approach to supporting the continued growth and development of a decentralized network without having to rely on a specific centralized entity. It opens up a new paradigm for funding developers in a direct and decentralized way by utilizing a decentralized decision-making process and aligning the incentives of network participants.

This functionality (inflation funding) empowers the blockchain to effectively fund its own development, ensuring its long-term success and survival. Over time, the goal is for a wide variety of developers to work full-time on the Tezos public blockchain.

— Kathleen Breitman, Co-founder of Tezos in one of her articles

Right after the Athens upgrade happened in 2018, one of my coworkers said, “can’t wait to see the next million dollar proposal”, and I share those same sentiments. The future of Tezos is truly bright with innovation happening at the highest levels, I can’t wait to see what the future holds. I hope you found this article interesting! Make sure to subscribe and share it with people that aren’t aware of this feature!