Tezos Q3 2025: What the Data Shows

Cutting Through the Narratives with Messari's Q3 Data

5 minute read

Crypto timelines love drama. A quiet week becomes a prophecy, a fee chart becomes a verdict, and a handful of opinions turns into “the state of the chain.” But every quarter, Messari does something extremely refreshing, it ignores the noise and looks at what actually happened on-chain. Their Tezos Q3 2025 report does exactly that, and it’s the basis for everything we explore in this article.

Q3 2025 wasn’t a flashy quarter for Tezos. It didn’t deliver a headline moment or a massive breakout. Instead, it showed something more useful, real signals about where the ecosystem is going as it grows and evolves.

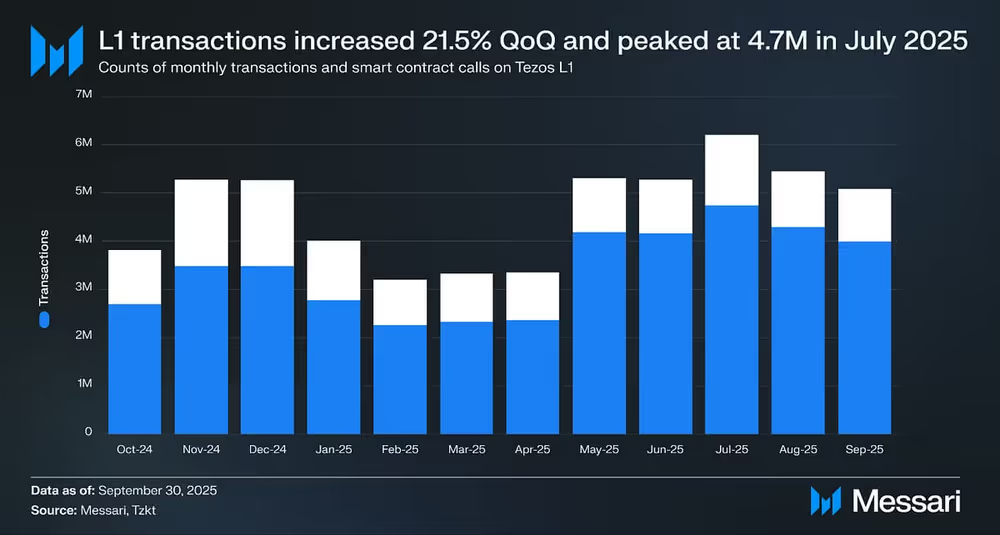

The L1 Got Busier #

Source: Messari Report

If you went by timeline chatter, you might think Tezos L1 was slowing down as more activity appears on Etherlink. But the data showed the opposite. L1 activity grew 21.5% quarter-over-quarter, with July alone recording more than 4.7 million transactions, the busiest month of the entire period. L1 fees also rose 16.9%, not because of congestion, but because the chain was being used more steadily.

Validator participation remained steady as well, with the staked supply barely moving. And with the Seoul upgrade introducing native multisig, aggregated attestations, and smoother staking flows, the L1 ended the quarter stronger than it started.

Etherlink Activity Cools, Engagement Holds #

Etherlink’s charts in Q3 looked quieter than the previous quarter, and Messari makes clear that the drop in fees, down 36.7%, reflects a real cooling of activity after the extremely active, incentive-driven stretch in Q2, as well as the refinement of the fee structure through the last upgrades.

With Apple Farm Season 1 wrapping up at the end of Q2 and Season 2 taking time to ramp, the transactional churn that defined earlier Etherlink naturally slowed. Even so, the underlying network didn’t stagnate. Daily active addresses actually rose 33.8%, suggesting that while users executed fewer transactions overall, the number of people present and interacting with it continued to grow. That’s an important distinction: engagement became steadier, even as raw volume eased off.

On the technical side, Etherlink became smoother and more predictable. Kernel 4.1 increased throughput and improved responsiveness, and the introduction of native Etherlink deposits on KuCoin gave Etherlink a major, straightforward centralized on-ramp.

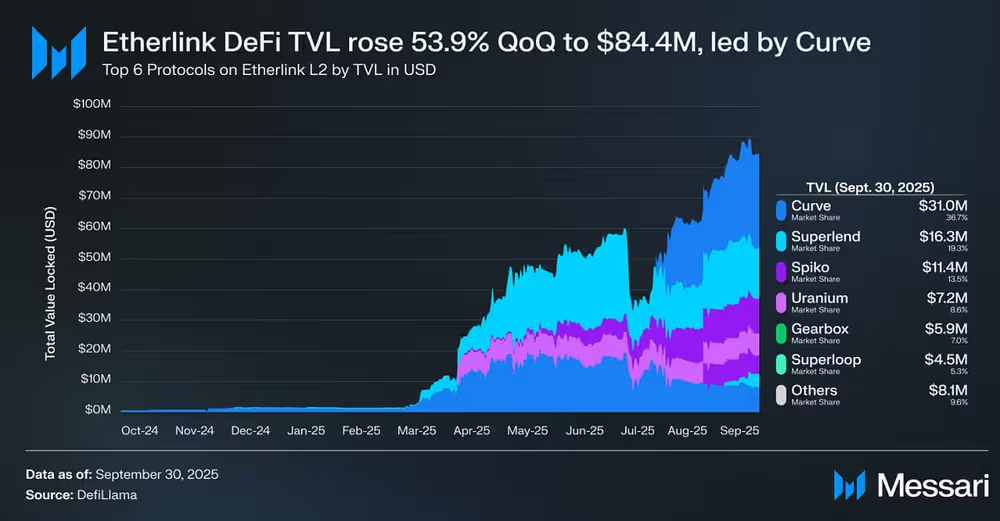

DeFi Reorganizes, and Etherlink TVL Hits a New High #

Source: Messari Report

DeFi on Tezos didn’t expand in a straight line this quarter, it reorganized. Etherlink liquidity dipped early in Q3 as incentives cooled, but the rebound was stronger than the drop. By the end of the quarter, Etherlink reached a new all-time high of $84.4M in TVL, up 56.4% QoQ. Curve’s rapid climb played a big role here, and it wasn’t alone, Spiko and Uranium.io also saw growing activity as the quarter went on.

L1 DeFi had a quieter but still positive quarter. It closed at $45.1M, a 13.1% increase, with Youves remaining the main source of stability and most other protocols holding steady.

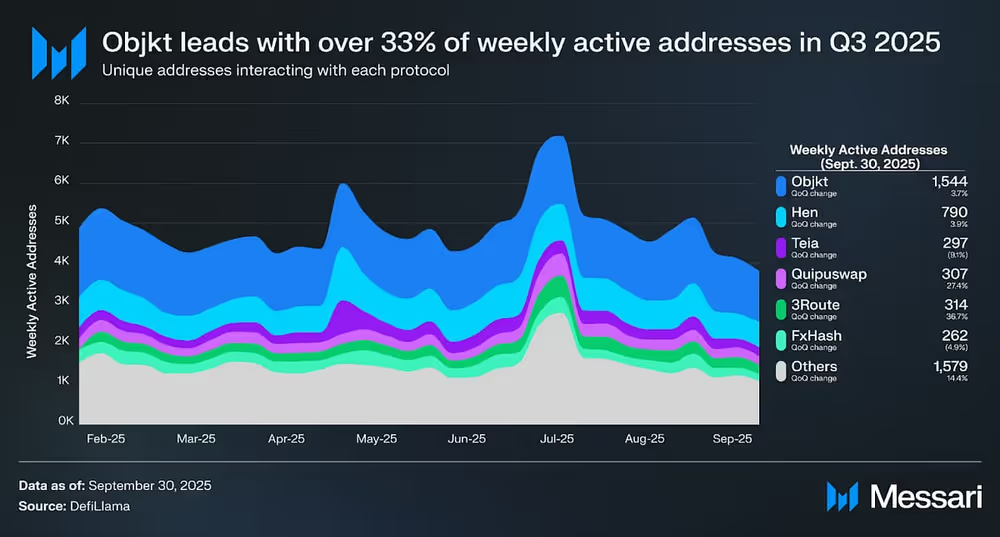

Culture Remained a Steady Anchor #

Away from the charts and liquidity shifts, the cultural side of Tezos stayed active in Q3. Objkt continued to lead the NFT landscape on the network, averaging around 1,544 weekly active wallets during the quarter. That’s a level of participation that shows the consistency of the community behind it.

Activity extended beyond the chain as well. Events like RGB MTL and new exhibitions from established Tezos artists such as Zancan added to the visibility and momentum of the ecosystem’s creative scene. Messari highlights this too, noting that Tezos continues to maintain one of the strongest and most engaged art communities in crypto. It’s a part of the ecosystem that doesn’t rely on rewards or seasonal spikes, it persists because the culture is active and committed.

Source: Messari Report

Looking at the full picture, Q3 ended up challenging several assumptions that tend to surface whenever the market cools. L1 activity wasn’t fading, it increased. The belief that Etherlink had already peaked didn’t match a quarter where user participation grew even as incentives tapered off. And the claim that DeFi was losing momentum ran directly into Etherlink closing the quarter at a new all-time high in TVL. Even the familiar “NFTs are dead” narrative didn’t align with steady engagement on Objkt and the ongoing presence of Tezos artists in exhibitions around the world.

None of these signals was loud, but together they point to an ecosystem that continues to mature in ways that aren’t always visible on the surface. A quarter without hype can still be a quarter of progress. Q3 was exactly that. For anyone who wants to dig deeper into the numbers behind all of this, the full Messari Q3 2025 report is well worth a read.