Understanding "Adaptive Issuance" In Less Than 10 Minutes

Let's dive into Adaptive Issuance on Tezos

1,450 words, 8 minute read

Tezos’ 15th protocol upgrade proposal “Oxford” has been announced and the most important feature it includes is “adaptive issuance”. Adaptive issuance, if implemented, will be the biggest change in the economic model of Tezos since mainnet so it’s only natural to spark a lot of discussions and debates.

It’s important to note that Oxford getting approved and activated via governance doesn’t mean the automatic activation of adaptive issuance, instead, a separate mechanism will need to be used to activate adaptive issuance afterward.

As with any change, and since we are talking about blockchain technology, things can get pretty complicated. So in this article, I will explain how the current issuance model of Tezos works, what changes adaptive issuance will bring (if/when activated), and what it means for both bakers and delegators.

Current Tezos Issuance Model #

As I explained in this Twitter post, with its current model, Tezos has a fixed number of new tez that are being created every block which amounts to approximately ~44.6 million tez per year or 4.6% inflation with the current Tezos supply.

These tez are being rewarded to bakers who validate blocks and their delegators who by delegating their tez to a baker help them get more blocks and attestations (previously known as endorsements). In this model, only bakers are required to lock their tez as bonds to secure the chain while delegators have their funds liquid and risk-free at all times.

Since delegation is very convenient for users (no need to setup a bakery) and even though it isn’t directly securing the chain, (no funds locked) most users choose this option and this has led to only ~7.5% of the supply being locked and securing the chain (locked tez via bonds). So how do we make sure that this number doesn’t go lower and that there are enough tez securing the chain? Enter adaptive issuance!

Adaptive Issuance #

In contrast to the current issuance model, where the number of new coins created is fixed regardless of the tez that are securing the chain, adaptive issuance comes to correlate these two and makes sure we have enough incentives for people to secure the chain.

Stated simply, we set a target of staked***** tez that we want to secure the chain (more on the numbers later) and we make the protocol increase or decrease emissions according to how far off that target we are and for how long we have been away from it.

*By staked I mean tez that are locked as bonds and not delegations.

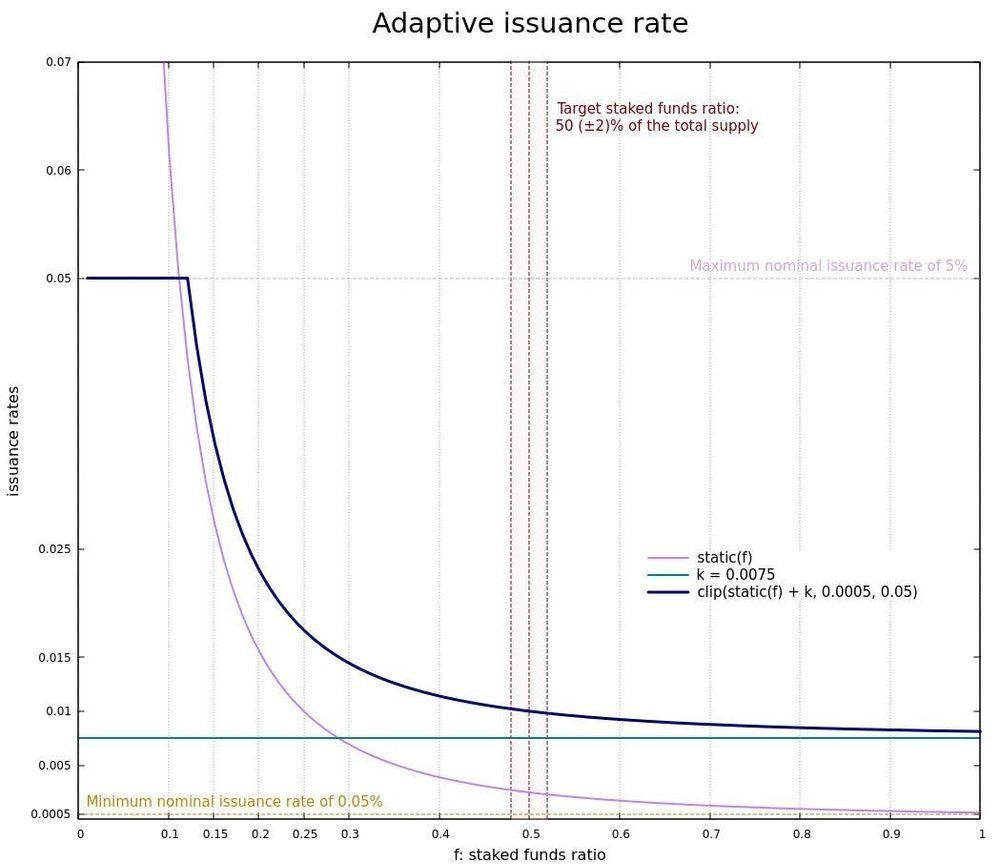

To achieve that, we will have two different issuance rates implemented: The static rate and the dynamic rate.

- Static rate is correlated to the number of tez we have staked. In simple terms, the more tez that is being staked***** (more secure chain), the less emissions. The fewer tez we have staked (less security), the more emissions to incentivize users to stake more. This rate, as the name denotes is static and you can think of it as the “base” issuance.

- Dynamic rate is correlated to how far from the target staked ratio we are and how long we have been outside of that target ratio range. For example, if we have staked funds that are 10% lower than the target, the dynamic rate will keep increasing every day by a specific rate and if we are 20% lower than the target, the dynamic rate will increase even faster every day and so on until we reach the target ratio range. The same thing happens for the opposite scenario where we have more staked funds than the target, but in that case, the dynamic rate decreases.

The sum of the static and the dynamic rates will be the total issuance. Let’s take a look at some numbers.

Looking at the graph there are a few important points we need to remember:

- The target staked funds ratio is 50% of the total supply

- The maximum issuance we can ever get to is 5%

- The minimum issuance we can ever get to is 0.05%

So taking into consideration all of the above, the issuance we will have when we reach the 50% target, will depend on how fast we get there. The faster we get to 50% staked funds, the fewer emissions we will have because the dynamic rate is lower. The longer it takes to get there, the higher the dynamic rate and the higher total emissions we will have. Does it make sense yet?

Bakers, Delegators, And Now, Stakers! #

At this point, some of you might be asking yourself, “how are we going to get to 50% staked tez (locked as bonds)? Isn’t that target too high when we currently have only 7.5%?”. The solution to that is “Stakers”, a newly introduced staking mechanism that borrows features from both delegators and bakers and gives you the best of both worlds.

More specifically, as a staker, you will be able to stake your tez from inside your wallet. Just as a delegator, you will choose a baker to stake your tez with but this time your tez will be locked for a specific period of time as bonds (again, from inside your wallet, you won’t be sending them anywhere) as if you were a baker yourself.

You can think of it as being able to bake your tez without having to set up the baking infrastructure yourself and instead “borrowing” an already existent baker’s setup. For that service, a fee for the baker will be withheld from your rewards (same as with delegating) but this time all the reward distribution will be done by the protocol itself and not by the baker or any 3rd party software(on chain rewards). Less headache for the bakers, and less risk of losing rewards from bad actors for the stakers, win-win!

But if as a staker, I will have my funds locked, why would I choose to stake my tez instead of delegating them? Few reasons:

- Staking will have double the weight of delegations for baking rights so that means higher rewards

- Rewards are distributed automatically from the protocol for stakers so less trust is required

- You are actively making the chain more secure

What Does It Mean For Bakers? #

For adaptive issuance, bakers will be able to set specific parameters individually. These parameters will include:

- how much of their balance will be used as bonds

- if they accept stakers and how much external stake they accept

The maximum stake a baker can accept is 5 times the number of their own funds. Anything above that will be considered as delegation for which the limit remains nine times the number of their own funds.

If for example, a baker chooses to bake with 10k tez, he can potentially accept 50k tez as extra stake from stakers and another 90k tez as delegations on top of that.

As we said earlier, having more stake gives you more blocks to bake compared to delegations, so more rewards. With that in mind, I would expect bakers to focus on attracting as much external stake (stakers) as possible to get an edge over their competition.

“Adaptive Issuance” has the potential to reshape the economic landscape of Tezos, marking a significant departure from the current issuance model. While Oxford’s approval and activation represent a momentous step forward, it’s important to re-emphasize that the implementation of adaptive issuance will involve a separate mechanism for activation.

The introduction of the “Stakers” mechanism adds yet another dimension to the Tezos ecosystem, offering a compelling alternative for those seeking to actively contribute to the network’s security. As the Tezos community engages in debates and discussions, the future implications of this upgrade remain both exciting and thought-provoking!

As always, I tried to keep things as simple as possible which means there is a lot more information and details around this topic and I encourage that you can look into by visiting the links below which are also the sources I used for this article.

Resources: